Imbalanced tax structure worsens income inequality

- Update Time : Friday, June 13, 2025

Staff Correspondent:

An imbalanced tax structure exacerbates income inequality in Bangladesh, underscoring the need for reforms to increase direct tax contributions, according to a recent publication by the finance ministry.

The Medium-term Macroeconomic Policy Statement (MTMPS) for FY26 highlights the revenue authority’s over-reliance on indirect taxes, namely value-added tax (VAT) and supplementary duty (SD).

In FY24, VAT and SD, which are paid by consumers, accounted for 3.86 percent of gross domestic product (GDP).

Income taxes contributed only 2.26 percent of GDP, said the MTMPS, suggesting a focus on increasing direct tax contributions and enhancing revenue generation.

In Bangladesh, income inequality, as reflected by the Gini coefficient—which measures the distribution of income and wealth within a population—rose to an all-time high of 0.499 in 2022, up from 0.482 in 2016.

The Gini coefficient measures inequality on a scale from zero to one, with zero reflecting perfect equality and one indicating perfect disparity.

The finance ministry report shows that indirect taxes account for over two-thirds of the total revenue collected by the National Board of Revenue (NBR), the main collector, as the government continues to rely on VAT, customs tariffs, and SD for tax income.

Mohammad Abu Eusuf, a professor of development studies and director at the Centre on Budget and Policy at the University of Dhaka, said the proportion of income tax should be increased while VAT and SD should be reduced to address inequality.

The MTMPS said the existence of a large informal economy is a major problem.

“Despite consistent economic growth and a structural transition from agriculture to manufacturing and services over the past two decades, informality continues to represent a significant share of economic activity,” the report said.

“The widespread informality in the Bangladeshi economy leads to significant tax losses, limiting the country’s ability to maximise revenue collection.

“However, it also presents a valuable opportunity to expand the tax base. By integrating informal activities into the formal economy and improving compliance, Bangladesh can tap into substantial potential for increasing revenue and strengthening public finances.”

The report said that a key step in reducing inequality is broadening the tax base by increasing the number of direct taxpayers.

“Expanding the tax net through improved compliance is a top priority. To improve tax compliance and raise the share of direct taxes, automating tax administration is crucial,” the report said.

It also noted that while some progress has been made in automating VAT and income tax systems, these efforts must be accelerated to include all taxpayers.

“Full automation of the tax filing process, especially the online submission of returns, will streamline operations, reduce evasion, and eliminate administrative inefficiencies.”

The report also highlighted the mismatch between GDP growth and tax collection, which is a major reason why Bangladesh lags behind similar economies in revenue collection.

The MTMPS noted that tax growth lagging behind GDP growth indicates significant revenue potential.

It used revenue buoyancy, an important indicator of a country’s revenue performance, to measure how revenue responds to changes in GDP. A buoyancy coefficient greater than one indicates that tax revenues are growing faster than GDP, while a coefficient of less than one suggests the opposite.

For Bangladesh, revenue buoyancy was calculated using real GDP growth rates and real revenue growth rates from FY13 to FY24. The average revenue buoyancy over this period is 0.83, indicating that tax revenues are growing at a slower pace than GDP, the report said.

Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue, said when tax collection is skewed towards indirect taxes, the burden of tax is disproportionately borne by people with lower incomes.

“The primary weakness of the tax collection structure in Bangladesh is tax evasion. The share of income tax collection is very poor in Bangladesh compared to similar countries in terms of per capita income. There is a serious mismatch between the wealth we see around us and the tax paid.

“We have been advocating for years to integrate databases across government agencies. The land and flat registration databases should be matched to see if they are fully reported in the tax files of the owners,” he said.

EFFECTIVE VAT RATE MUCH LOWER THAN STANDARD RATE

Revenue potential also exists in VAT.

The MTMPS said the effective VAT rate, which is calculated by comparing VAT revenue to total consumption in the real sector, fluctuated within a narrow range of 3.5 percent to 3.9 percent from FY16 to FY24.

In FY24, the effective VAT rate was recorded at 3.7 percent, substantially below the standard rate of 15 percent on goods and services.

“This gap indicates significant potential for improving VAT efficiency and compliance.”

To address these challenges, the government has taken several reform initiatives, including separating tax administration from policy, mandating online submission of income tax returns, applying the standard 15 percent VAT rate on goods and services, and removing exemptions.

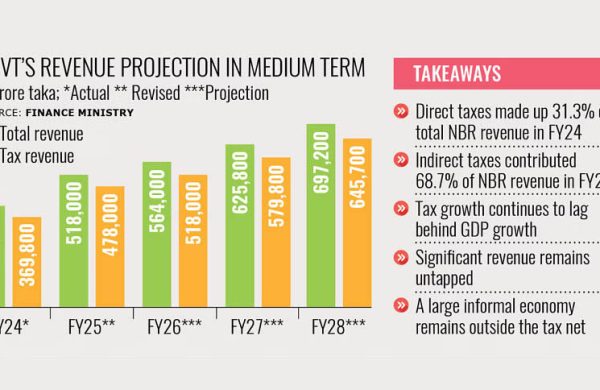

Over the next three years, the government forecasts that revenue collection will grow by an average of 10.4 percent annually, reaching Tk 697,000 crore by FY28.