Liquidity mishandling lands dozen banks in quagmire

- Update Time : Sunday, September 22, 2024

- Risky aggressive lending for corporate malgovernance also to blame

TDS Desk:

At least 11 of mushrooming private commercial banks (PCBs) in Bangladesh faced with financial vulnerability mainly for a lack of proper liquidity management, bankers said, warranting government intervention.

Weak corporate governance has also encouraged aggressive lending that has also pushed up the volume of classified loans significantly at these banks, they explained.

The banks, whose boards have already been reconstituted following regime change in state power, are Islami Bank Bangladesh, Social Islami Bank, Global Islami Bank, Union Bank, National Bank, First Security Islami Bank, Bangladesh Commerce Bank, Al Arafah Islami Bank, United Commercial Bank, Exim Bank and IFIC Bank.

The loans and advances from most of these banks have exceeded their deposits, in infraction of standard banking rules, regulations, and norms.

“In some cases, the banks have used their capital alongside funds borrowed from other banks and the central bank to finance their lending,” says one of them about suspicious lending that economists link to the siphoning off of funds.

In a twist, some of these banks provided loans and paid cash dividends to shareholders with money borrowed from the central bank under the lender-of -last-resort facility.

A lender of last resort is an institution, usually a country’s central bank, that offers loans to banks or other eligible institutions that are experiencing financial difficulty or are considered highly risky or near-collapse.

For instance, Islami Bank’s investments — essentially loans and advances — stood at Tk 1,722.35 billion, some Tk 127.67-billion higher than its total deposit base of Tk 1,594.68 billion during the first half (H1) of 2024.

According to the bankers, these banks were not maintaining liquid assets in accordance with the existing Bank Company Act, specifically its sections 25 and 33.

Under Section 25, every banking company, not being a scheduled bank, must maintain a cash reserve in Bangladesh equivalent to not less than 4.0 per cent of its liabilities.

As per Section 33 of the Bank Company Act 1991 (amended in 2013), banks are required to hold Treasury Bills (T-Bills) and bonds as part of their Statutory Liquidity Ratio (SLR) to cover liabilities.

Meanwhile, the now-embroiled S Alam Group and its associate entities reportedly borrowed a king’s ransom of Tk 953.31 billion from six banks between 2017 and June this calendar year, plunging them into a severe liquidity crisis.

Of the sum, around 79 per cent or Tk 749 billion came solely from Islami Bank. It accounts for 47 per cent of the lender’s total outstanding loans as of March this year.

Besides, five banks — National Bank, First Security Islami Bank, Social Islami Bank, Union Bank and Global Islami Bank — out of 11 have a negative balance in their current accounts with the central bank.

As of August 7, the five banks and Bangladesh Commerce Bank’s combined current-account deficit with the central bank stood at Tk 146.21 billion. If their cash-reserve- ratio deficit is considered, their total shortfall comes to Tk 207.74 billion, according to the central bank data.

On the other hand, overall NPLs of 11 troubled banks stood at Tk 478.73 billion as on June 30 this calendar year. The amount is nearly 23 per cent of total classified loans amounting to Tk 2113.92 billion in the banking system.

However, the reconstituted boards and senior management teams at these banks are now working to improve their financial health by intensifying recovery efforts and strengthening deposit mobilization.

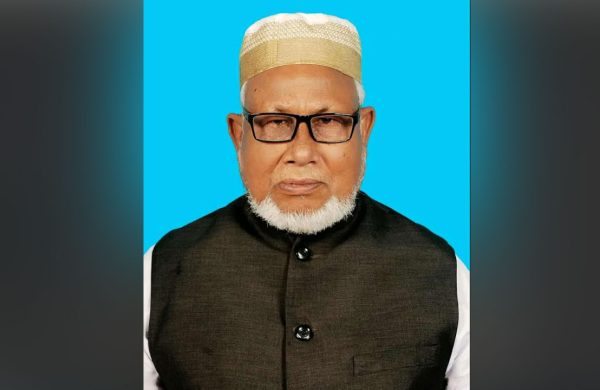

“We’ve already geared up recovery drives across the country,” Mohammad Abdul Mannan, chairman of First Security Islami Bank, told that, adding that his bank has already been able to recover around Tk 2.25 billion in the rescue process.

Mannan, a former managing director (MD) and CEO of Islami Bank, emphasized that the new board members have been appointed to protect depositors’ interests. “We are now working in line with the central bank’s advice to safeguard depositors.”

Md. Ali Hossain Prodhania, Supernumerary Professor at Bangladesh Institute of Bank Management (BIBM), has opined in favour of appointment of external auditors to conduct ‘functional audit’ to assess the quality of assets and to ascertain the real damage done to those banks.

“How much loans and advances are really unclassified? Prodhania, also former MD of Bangladesh Krishi Bank, posed the question, saying that real figures of classified loans are likely to be higher than that of the reported ones by the banks.

He also emphasizes assessing the real market value of collaterals and tracing recoverable assets for attachments other than mortgaged.

“Responsible officials of banks concerned should be brought under legal and administrative actions,” the senior banker suggests, appreciating the recent move of Bangladesh Bank.

He also recommends proper recovery steps alongside legal actions against the wilful defaulters.

In a notable development, the NPLs of National Bank more than doubled in H1 2024 compared to the same period in 2023, jumping by nearly 123 per cent to Tk 209.29 billion, the highest among all PCBs during that time, from Tk 93.92 billion a year earlier, according to the central bank statistics.

Around Tk 60 billion was added up to the NPLs during the period under review as some writ petitions relating to loan status were vacated, officials of the bank explained.

They also stated that the bank is now strengthening its recovery efforts and deposit mobilization in line with directives from its reconstituted board.

“We’ve already been able to recover cash amounting to Tk 7.0 billion from June to August 2024,” Md. Touhidul Alam Khan, managing director (MD) and chief executive officer (CEO), told that in reply to a query.

He adds: “Our bank had earned Tk 745 million in monthly profit by June 30, 2024, following 29 consecutive months of losses.”