Listed textile giants show resilience amidst challenges

- Update Time : Sunday, November 17, 2024

TDS Desk

Despite challenges like political turmoil, economic uncertainty, and worker unrest, listed giant textile companies reported year-on-year revenue growth for the September quarter of the current fiscal year 2024-25.

However, many textile mills experienced revenue declines during this period, showcasing mixed performance within the sector.

Showkat Aziz Russell, president of the Bangladesh Textile Mills Association, told media that the devaluation of the local currency had a somewhat positive impact on the textile sector, particularly benefiting larger companies. He explained that these firms have higher production capacities, greater operational efficiency, and stronger buyer trust, which helped them withstand the adverse effects of the challenging times.

Envoy Textiles Limited, the world’s first LEED-certified green denim manufacturing facility, reported a 134% increase in net profit for the July-September period compared to last year.

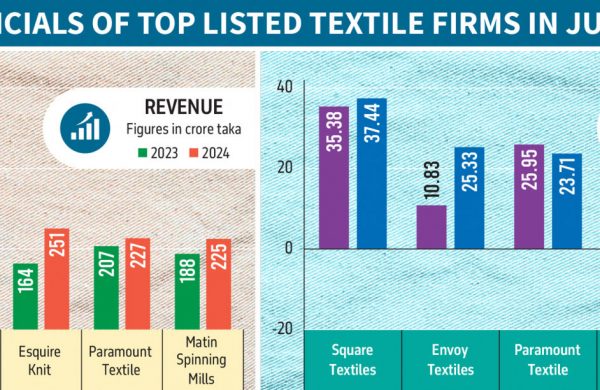

According to its unaudited financial statement, the company achieved revenue of Tk440 crore, 40% up from Tk315 crore in the previous year. Its profit after tax increased to Tk25.33 crore during the quarter, compared to Tk10.83 crore a year ago.

Tanvir Ahmed, managing director of Envoy Textiles, said the mill operated at 92% capacity in the first quarter of the fiscal year. In November, the company secured full-capacity orders to produce 45 lakh yards of denim fabric.

“We have strong orders for the next month and projections from leading buyers for January onwards, which should allow us to maintain full-capacity operations,” he said.

To add value, the company plans a new recycling plant in line with global brands’ goals to increase recycled yarn usage by 2030. Envoy Textiles has already recommended a 20% cash dividend for its shareholders for FY24, up from 15% in FY23.

Square Textiles PLC also posted impressive revenue growth in the September quarter, driven by increased yarn production from its new project in Gazipur.

The company achieved revenue of Tk577 crore, a 31% increase from Tk441 crore in the same quarter last year. Profit after tax rose to Tk37.44 crore, compared to Tk35.38 crore a year ago.

Square Textiles has proposed a 32% cash dividend for FY24, exceeding the previous fiscal year’s 30% dividend.

Matin Spinning Mills Ltd, a sister concern of DBL Group, reported a 20% year-on-year profit growth in the September quarter.

The company’s unaudited financial statement showed revenue of Tk225 crore, up from Tk188 crore a year ago. Profit after tax reached Tk10 crore, a significant turnaround from a loss of Tk5 crore in the same quarter last year.

The company attributed its 20.03% increase in sales revenue to higher average sales prices, which rose from $3.55/kg to $3.63/kg, and increased sales quantities, which grew from 4,935 tonnes to 5,175 tonnes. Additionally, a reduction in the cost of sales — from 96.92% to 84.23% — boosted the gross profit margin from 3.08% to 15.77% and turned the net profit margin positive, increasing from -2.66% to 4.44%.

Paramount Textile Limited, a subsidiary of Paramount Group, reported a 10% revenue growth in the July-September quarter.

The company achieved revenue of Tk227 crore, up from Tk207 crore in the same period last year. However, its profit after tax fell to Tk23.71 crore, compared to Tk25.95 crore a year ago. Paramount attributed the missed export target to the ongoing global economic crisis.

The performance of the listed textile companies underscores their resilience amid sector-wide challenges, with larger firms benefiting from operational efficiencies and buyer confidence.

According to the stock exchange, 58 textile companies are listed on the bourses. Last week, investors were most active in the pharmaceutical sector, which accounted for 15.7% of market activity, followed by the banking sector at 12.8%, and the textile sector at 9.5%. The textile sector delivered a return of 0.70% during the week on the Dhaka Stock Exchange.