Many banks are ‘clinically dead’, says CPD

- Update Time : Monday, August 12, 2024

Staff Correspondent:

The Centre for Policy Dialogue think-tank says that several banks across Bangladesh are ‘dying’ and many are ‘clinically dead’.

According to the organisation, the ‘dying’ banks can still be revived if an effort is made.

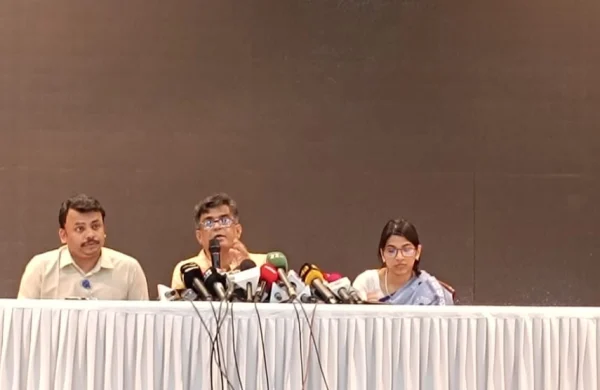

While suggesting that these banks’ management and board of directors need to be changed, CPD Executive Director Fahmida Khatun told that: “Many banks have become clinically dead. These banks will not be able to get back on their feet. They need to be allowed to die naturally. The government is keeping these banks running by pouring in more money and capital.”

She made the comments on Monday while speaking at a press briefing at the CPD’s office in Dhanmondi.

Despite not knowing the exact number of ‘dying’ or ‘clinically dead’ banks, Fahmida said: “According to the 2021 bank reports, 11 banks failed to reserve provisions at different rates per the Basel principles of international standards.”

“Third and fourth-generation banks are clinically dead. Once upon a time, Islami Bank Bangladesh was a good bank. However, it is now dead after the takeover.”

After Bangladesh gained independence, the economy was in shambles. Then the banking sector came forward to revitalise the economy by helping develop entrepreneurs, and raising funding. Many big groups have been born today due to the role played by the banking centre for industrialisation, she added.

While stating that these groups play a huge role in Bangladesh’s economy, Fahmida said: “The country’s banking sector is now working to grow the influence of individuals and groups. The rules are being made for the few existing groups.”

The CPD executive director also remarked that the entire banking sector is now operating outside of the rules and regulations.

“Bangladesh Bank has lost its independence. There have been 24 major scams in the banking sector amounting to over Tk 920 billion in misappropriated funds.”

While recommending the formation of a three-month banking commission to identify and solve the banking sector’s issues, the organisation said that the financial institutions department of the finance ministry should be closed to reduce the dual administration of the banking sector.

The CPD also reported that Bangladesh Bank does not control government banks for the financial institutions department.

According to Mostafizur Rahman, an honorary fellow of the CPD, forming a bank commission is crucial to breaking the vicious cycle of the banking sector.