Meghna Group withholds Tk862 cr in gas bills

- Update Time : Saturday, April 19, 2025

- 16 Time View

Staff Correspondent:

Meghna Group’s subsidiaries, Everest Power Generation Company Limited and Meghna Sugar Refinery Limited, owe Titas Gas Transmission and Distribution Company Limited approximately Tk862 crore in unpaid gas bills.

This substantial debt has been accumulating over several years, severely affecting Titas Gas’s financial health and its ability to maintain consistent gas supply operations.

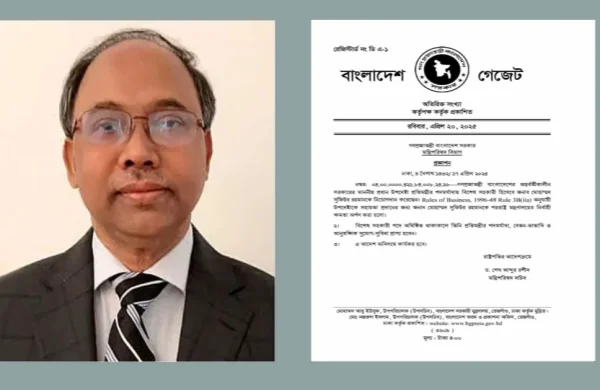

Industry insiders allege that the close relationship between Meghna Group’s chairman, Mustafa Kamal, and the previous Awami League government facilitated the delay in settling these substantial dues. Attempts by Titas officials to recover the outstanding payments reportedly led to their reassignment or removal, hindering effective debt collection efforts.

Everest Power Generation Company Limited, initially established as a captive power plant, later transitioned to an Independent Power Producer (IPP). Despite this change, the company allegedly continued to pay for gas at the lower captive rate, contravening Bangladesh Energy Regulatory Commission (BERC) directives that mandate IPPs to pay at higher rates applicable to their category.

BANGLADESH FIRST

Facing persistent non-payment, Titas Gas is reportedly preparing to take stringent measures, including the disconnection of gas services to Meghna Group’s defaulting subsidiaries. This move aims to compel payment and mitigate further financial losses.

Beyond unpaid gas bills, Meghna Group is under investigation for various financial misconducts. Allegations include embezzlement of bank commissions, avoidance of stamp duties, and misappropriation of funds from compulsory insurance policies. The Anti-Corruption Commission has initiated probes into these matters, reflecting the severity of the accusations.

In light of ongoing investigations, the Bangladesh Financial Intelligence Unit (BFIU) has instructed banks to freeze the accounts of Mustafa Kamal, his wife, and children. This action aims to prevent potential asset flight and ensure accountability during the investigative process.

Reports indicate that Meghna Group has secured bank loans exceeding Tk16,768 crore across its 55 entities. The scale of these borrowings, coupled with allegations of financial improprieties, has prompted concerns about the group’s financial practices and the potential risks posed to the banking sector.

Additional allegations against Meghna Group include unauthorized industrial constructions on riverbanks, illegal land acquisitions, and environmental degradation due to unregulated activities. These infractions have drawn criticism from environmental groups and regulatory bodies, further complicating the group’s legal challenges.

Attempts to reach Mustafa Kamal for his perspective on these allegations have been unsuccessful. As investigations continue, stakeholders await official statements from Meghna Group’s leadership to address the mounting concerns.