Monetary Policy: Private sector unhappy with lower credit flow target

- Update Time : Tuesday, February 11, 2025

Staff Correspondent:

Bangladesh Bank has announced another tight monetary policy to curb inflation, but business leaders oppose the move, arguing that its objectives may not be achieved without due consideration for investment and employment.

The new policy, they claim, fails to meet the needs of the business sector and the level of investment required for Bangladesh’s economic growth.

Economists acknowledge that the economy is gradually stabilising, but they stress that monetary policy alone cannot combat inflation—other factors must also be taken into account.

They argue that inflation has eased due to an increased supply of food items from domestic sources.

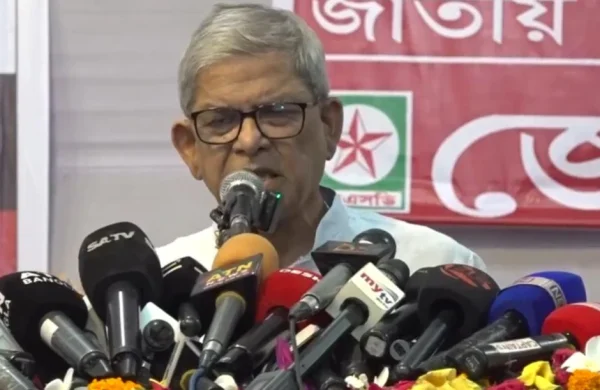

Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) President Abdul Awal Mintoo said monetary policy is an essential tool for controlling inflation. “I do not believe a contractionary monetary policy alone can effectively control inflation in a country like Bangladesh. Investment policy should also be revised.”

He explained that a reduced money supply in the private sector would negatively impact businesses and trade, particularly since almost all raw materials used in production must be imported.

“We import nearly all consumer goods except for one or two. In such a scenario, adopting a contractionary monetary policy with the expectation of reducing inflation is not logical,” said Mintoo, a prominent businessman and political figure.

He attributed the decline in inflation in December and January to the ample supply and lower prices of winter vegetables, which are abundant in Bangladesh from December to February.

“When the supply of vegetables declines, prices will rise. Besides, we will need to import 2 million tonnes of rice, which will require foreign exchange. As foreign exchange is diverted to these sectors, the local currency, taka, may depreciate,” he warned.

President of the Dhaka Chamber of Commerce and Industry (DCCI) Taskeen Ahmed told UNB that Bangladesh Bank’s decision to maintain a contractionary monetary policy in H2 FY2024-25, keeping the policy rate at 10 percent, is concerning for businesses.

“This rigid stance hampers private sector credit growth and economic expansion. The private sector relies heavily on banks for investment, and high interest rates increase production costs, fueling inflation,” he said.

Despite inflation easing to 9.94 percent in January 2025 from 10.89 percent in December 2024, it remains above the desired level, he pointed out.

Ahmed also expressed concern over the decision to maintain the private sector credit growth target at 9.8 percent for January-June FY25, while actual growth fell to 7.3 percent in early 2025—the lowest in 12 years.

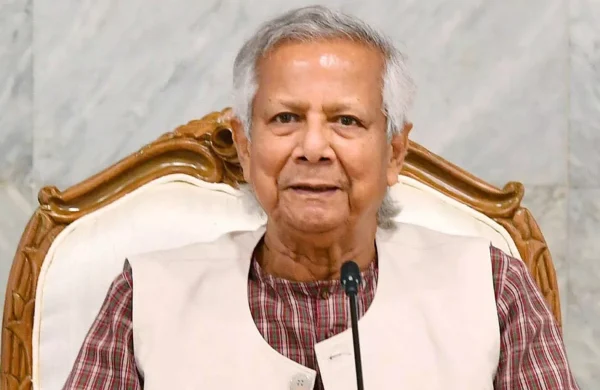

Economist and former Bangladesh Bank chief economist Mustafa K Mujeri said, “In Bangladesh, inflation cannot be controlled by monetary policy alone. Market management supervision and fiscal policy measures are also necessary.”

He noted that the contractionary monetary policy negatively affects investment, employment, and supply, preventing demand and supply from being fully reflected in the economy.

He, however, pointed out some positive signs for the economy, such as stability in foreign exchange reserves after a prolonged period of volatility. “The exchange market will stabilize further as inward remittances, exports, and foreign aid increase, along with improved agricultural production,” Mujeri said.

Although foreign direct investment (FDI) has declined in recent months, he believes the situation will improve with political stability.

Dr Masrur Reaz, former World Bank economist and public policy expert that macroeconomic stability has returned after a long period of instability, which is a positive development for the domestic economy.

Explaining the Purchasing Managers’ Index (PMI), a key economic indicator used to assess economic health, he noted, “The purchasing power of Bangladeshis has increased, which has positively impacted the consumer market. This indicates that the economy remains vibrant despite various challenges.”

Masrur described the monetary policy as both timely and necessary for curbing high inflation. He noted that the decision not to raise the policy rate would provide some relief to the private sector.

He also welcomed Bangladesh Bank’s stance on non-performing loans (NPLs), acknowledging that the issue had previously been concealed due to political influences and corruption. He added that adopting a global standard for NPL calculations would enhance public confidence in the banking sector.