NBFIs’ classified loans average 35%, with over 90% at 7 firms

- Update Time : Tuesday, January 7, 2025

TDS Desk:

The total NPLs of 35 institutions amounted to Tk26,163 crore, with 19 institutions reporting NPLs exceeding 50%, according to Bangladesh Bank data Non-bank financial institutions (NBFIs) are burdened with non-performing loans, which reached 35.52% by the end of September 2024, with seven institutions reporting NPLs between 90% and 99%.

The total NPLs of 35 institutions amounted to Tk26,163 crore, with 19 institutions reporting NPLs exceeding 50%, according to Bangladesh Bank data. Compared to June 2024, NPLs increased by Tk1,452 crore in just three months.

Central bank officials said most NBFIs are practically non-functional, with seven near-defunct, and the remaining institutions, which have over 50% defaulted loans, are struggling.

Many financial institutions violated banking rules by disbursing loans to shell companies through forged documents, with several institutions’ irregularities highlighted in the central bank’s report.

Golam Sarwar Bhuiyan, managing director of IIDFC, told The Business Standard, “Many institutions were defaulters earlier, but this was not disclosed, and rescheduling facilities during the Covid period are now turning into defaults.”

Speaking to TBS, Mominul Islam, former chairman of the Bangladesh Leasing and Finance Companies Association, said the boards of most financial institutions have created their own difficulties by approving loans for companies owned by directors or for ineligible entities.

Data shows that only seven out of 34 financial institutions have defaulted loans below 10%, including Alliance Finance, DBH Finance, IDLC Finance, IPDC Finance, Lanka Bangla, Strategic Finance, and Uttara Finance.

Meanwhile, the balance of financial institutions decreased from Tk74,918 crore in June 2024 to Tk74,140 crore in September, according to central bank data.

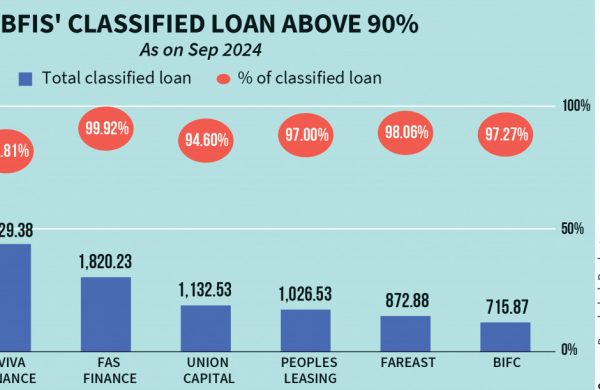

7 NBFIs hold over 90% default loans

The financial institutions with the highest defaulted loan rates include Aviva Finance, BIFC, Fareast Finance, FAS Finance, International Leasing, Peoples Leasing, and Union Capital.

Among them, Prashant Kumar Halder, known as PK Halder, was involved in various frauds at Bangladesh Industrial Finance Company (BIFC), International Leasing, FAS Finance, and Aviva Finance.

FAS Finance has a defaulted loan rate of 99.92%, or Tk1,820 crore. The Anti-Corruption Commission (ACC) has found initial evidence of Tk523 crore in embezzlement linked to 13 shell companies.

The graft watchdog has filed 13 cases in connection with the embezzlement from this institution, involving loan fraud totalling Tk1,300 crore, with fake and paper-based companies used to secure loans.

Fareast Finance also ranks among the top defaulters, with Tk872 crore in defaulted loans, or 98% of its total loan portfolio.

The ACC’s investigation revealed a loan fraud of Tk470 crore involving 31 companies through its subsidiary, Fareast Stocks and Bond Limited (FSBL), with loans issued in their names.

What sector stakeholders say

Mominul Islam further stated, “In a free-market economy, failing institutions should be allowed to close. However, in our country, deposit insurance coverage for customer deposits is very limited.”

He added, “Institutions that deserve to be closed should be shut down, while some could be merged.”

He suggested that if institutions close, arrangements should be made to return full deposits to small customers and partial amounts to those with large deposits, after reviewing the asset quality of these institutions.

The deputy managing director of a financial institution, speaking anonymously, told TBS that PK Halder is a highly controversial figure in the sector, with the entire industry bearing the consequences of his irregularities in various financial institutions.

He said many of his institutions, involved in loan fraud, have the highest default rates, and previously hidden default loans are now surfacing.

Despite having rescheduled loans earlier, these loans have now defaulted, and many businessmen who absconded after the August political changeover are also defaulting. As a result, default loans in financial institutions have risen.

Golam Sarwar Bhuiyan of IIDFC said the rise in interest rates on government bills and bonds has led to reduced investments in financial institutions. They are not now getting fresh deposits.

He added that business and trade are struggling due to the economic situation, and high loan interest rates are discouraging new investments.