Online tax boom: Filings near last year’s total with a month to spare

- Update Time : Tuesday, November 26, 2024

TDS Desk:

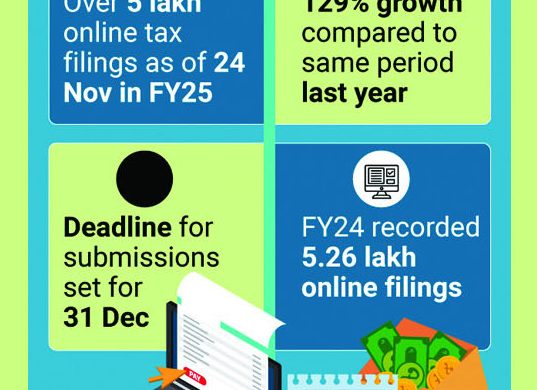

The submission of online tax returns for the ongoing 2024-25 fiscal year has witnessed significant growth, with over 5 lakh taxpayers filing e-returns as of 24 November – a staggering 129% increase from 2,17,471 during the same period last year.

Officials at the National Board of Revenue (NBR) expect a further surge in submissions as the 31 December deadline approaches, given the trend of last-minute filings.

In FY24, 5,26,487 taxpayers submitted their tax returns online, reflecting a steady rise since the launch of the online filing system in FY22, which recorded 61,491 filings. The number increased to 2,44,481 in FY23.

Meanwhile, the number of registrations for filing tax returns online has surpassed 12.5 lakh as of 24 November.

A senior NBR official noted improvements in the online tax return filing process this year.

“The experience of submitting tax returns online has been simplified. Taxpayers can now file their returns with just a few clicks,” the official told the Daily Sun on Sunday.

The NBR has ramped up efforts to promote the online system by offering training programmes, a dedicated call centre, and resources available on social media and the NBR website. These measures aim to assist taxpayers in navigating the automated system.

To ensure compliance, government officials and employees of scheduled banks, telecom companies, and large organisations in Dhaka, Gazipur and Narayanganj City Corporations are now mandated to file their returns online.

The tax return submission period, which began on 9 September, has been extended until 31 December to facilitate more filings. Across 41 income tax zones, 869 tax circle offices assist taxpayers with services like online TIN registration, return filing and e-payments through automated challans.

Taxpayers facing technical challenges can seek help from the NBR’s call centre. Additionally, after completing their online filing, users can easily download acknowledgement slips, tax certificates, TIN certificates and copies of submitted returns.

Former NBR chairman Muhammad Abdul Majid told the Daily Sun that the increasing popularity of online filing underscores its importance.

“It is essential to bring all taxpayers under the automated system. However, achieving this will require a robust database integrating information from institutions and national ID cards,” he said.

Currently, Bangladesh has 1.05 crore Taxpayer Identification Number (TIN) holders. Last fiscal year, 36.62 lakh taxpayers submitted their returns, up from 30.28 lakh in 2022-23. NBR officials are optimistic that the momentum will continue, driven by the simplified online filing process and enhanced support measures.