Overdue payments to LNG suppliers mount to $455m

- Update Time : Sunday, February 9, 2025

TDS Desk:

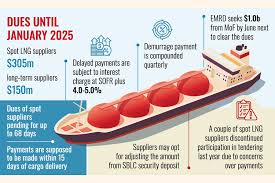

The government’s overdue payments to the liquefied natural gas (LNG) suppliers stood at around US$ 455 million as state-run Petrobangla has been struggling to clear the bills due to the shortage of US dollar, said sources.

If the payment situation doesn’t improve, the suppliers might go harsh, including ceasing LNG supplies and adjustment of the unpaid amount from the standby letter of credit (SBLC) kept by Petrobangla with state-run banks as the security deposit, market insiders feared.

Official sources said Petrobangla has been failing to clear the overdue payments to both long-term and spot LNG suppliers, and until late January, majority of the overdue payments remain pending with the spot LNG suppliers to the tune of around $305 million and to long-term suppliers around US$150 million.

Gunvor Singapore Pte Ltd, Excelerate Energy LP, Vitol Asia Singapore Ltd are the major spot LNG suppliers to Bangladesh and their overdue payments were pending for up to 68 days after the spot LNG cargo deliveries, said sources.

According to Master Sales and Purchase Agreements, signed with the spot LNG suppliers, the state-run entity is obliged to make payments within 15 days of delivery.

Of the two long-term suppliers, overdue payments of Qatar Energy alone amounted to around US$ 150 million until late January and the payments were pending for up to 46 days after a cargo was delivered.

Overdue payments of OQ Trading International, formerly known as Oman Trading International, were around US$30 million until late January.

According to the SPAs between Petrobangla and Qatargas, the state-run entity is obliged to make payment within 15 days of LNG delivery.

Petrobangla has the liberty to make LNG-import payment to OQ within 25 days of import, as stated in the SPA.

Failure to make regular payments against LNG imports will push the agency to make payment with interest at SOFR plus 4.0-5.0 per cent on the overall import bills.

The demurrage payment is compounded quarterly.

The government’s overdue payments against LNG purchase reached its peak in recent times, traders said.

Officials said the previous government was also struggling to pay against LNG purchases last year and, as a consequence, at least two spot LNG suppliers had given Petrobangla three working days to clear their unpaid bills totalling around $113 million or face supply halt.

At least a couple of spot LNG suppliers discontinued participation in tendering last year due to concerns over payments, a senior Petrobangla official said.

They also had forewarned of adjusting the unpaid amount from the SBLC kept by Petrobangla with state-run Agrani Bank Ltd as security money against LNG trading with the suppliers.

To ensure payment to LNG suppliers, the Energy and Mineral Resources Division (EMRD) under the Ministry of Power, Energy and Mineral Resources sought around $1.0 billion from the Ministry of Finance (MoF) by June, a senior official at the MoF.

Energy ministry officials say Bangladesh has never defaulted on paying LNG-import bills since the initiation of LNG import in 2018 and gas bills to international oil companies (IOCs).

“Global economic turmoil caused by the ongoing war between Russia and Ukraine, which has led to swelled prices for various commodities, including oils and grains, is the main cause of the country’s eroding repayment capacity,” says one official.