Private credit growth rises to 7.57pc in March after months of decline

- Update Time : Wednesday, May 7, 2025

Staff Correspondent:

After a seven-month streak of declining growth, private sector credit in Bangladesh rebounded in March 2024, rising to 7.57% – the highest in four months, according to a recent Bangladesh Bank report.

In February, credit growth had dropped to a 21-year low of 6.82%. The March figure reflects a notable improvement of 0.75 percentage points, equivalent to an increase of around Tk35,000 crore.

The central bank’s data shows that total outstanding credit to the private sector stood at Tk15.98 lakh crore at the end of February and rose to Tk17.19 lakh crore by the end of March.

Bankers attributed the rebound to increased import demand for essential commodities throughout the month of Ramadan, which spanned all of March. Additionally, some banks were required to convert long-overdue foreign currency loans into local currency, known as forced loans, further contributing to the rise in credit volume.

Since the fall of the Awami League government in August last year, the country has faced political instability and law and order disruptions, contributing to a persistent decline in private sector credit growth over the past seven months.

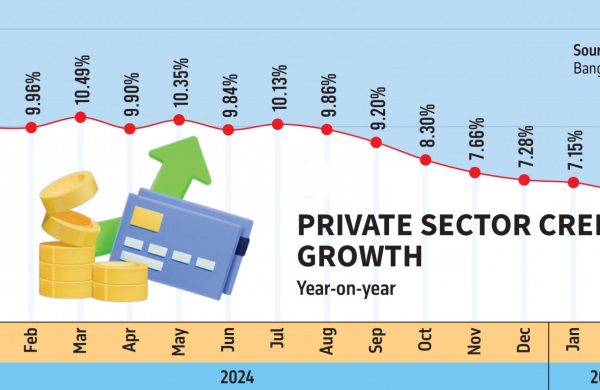

According to Bangladesh Bank data, private sector credit growth stood at 7.15% in January 2025, 7.28% in December, 7.66% in November, 8.3% in October, 9.2% in September, 9.86% in August, 10.13% in July, and 9.84% in June 2024.

The downtrend began in November 2022 but worsened following the political transition on 5 August 2024.

Despite a slight rebound in March this year, Bangladesh Bank’s latest quarterly report warns of ongoing challenges in the banking sector, including a sharp rise in non-performing loans (NPLs), sluggish overall credit growth, and capital shortfalls – all of which are severely limiting banks’ capacity to extend fresh credit.

As of December 2024, total NPLs surged by 21.33% in the second quarter of FY25, reaching a record Tk3.45 lakh crore, up from Tk2.85 lakh crore in the previous quarter.

Bangladesh Bank’s monetary policy for the second half of this fiscal year (FY25), announced in January, maintained a private sector credit growth target of 9.8% through July 2025.

Officials from the credit departments of several banks revealed that the rise in private sector credit growth in March was largely driven by increased imports of various goods ahead of Ramadan.

They said imports of edible oil, sugar, chickpeas, onions, and dates typically surge during Ramadan, which contributed to the higher credit growth in March.

“Another key reason for the growth was that several overdue foreign loans of Chattogram-based S Alam had to be converted into forced loans in local currency, which also pushed up credit growth,” one banker said, wishing not to be named.

According to central bank sources, both the opening and settlement of import letters of credit (LCs) in March surpassed the $6 billion mark, showing growth compared to the same month last year.

During the first nine months (July-March) of FY25, Bangladesh’s export sector posted a strong performance, earning $37.19 billion – up 10.63% from $33.61 billion during the same period in FY24.

Pubali Bank Managing Director and CEO Mohammad Ali “Our country has a large consumer base, and their demand hasn’t declined significantly. As a result, we’ve had to keep importing essential goods.”

He added, “We’re in a festive season – one Eid and Pahela Baishakh have passed, and another Eid is approaching. Import LCs for these goods are typically opened months in advance.”