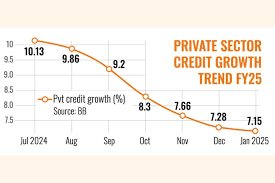

Private credit growth slips to decade-low 7.15pc

- Update Time : Monday, March 10, 2025

Staff Correspondent:

Since the fall of the Awami League government in August last year, the country has been experiencing political instability and disruptions in law and order, leading to a continuous decline in private sector credit growth over the past six months.

In January this year, private sector credit growth stood at 7.15%, the lowest in a decade, according to the latest data from the Bangladesh Bank.

The last time such low growth was recorded was in 2015.

January’s growth was 2.65 percentage points lower than the target of 9.80% that the central bank has set for the second half of the ongoing FY2024-25.

In December last year, loans to private firms grew only by 7.28%, according to central bank data.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, that law and order issues must be addressed to stabilise Bangladesh’s economy and revive investment. “Otherwise, reducing loan interest rates won’t attract investment.”

The pressure on borrowers has risen due to higher bank interest rates and increasing utility costs. Meanwhile, private sector credit growth slowing has signalled a major investment crisis in the economy.

Economic activity is declining as imports of capital machinery have dropped significantly. Despite creating 20-22 lakh new jobs annually, capital imports have not seen a substantial increase.

Industry people have said that the government must ensure certainty for investors. When investors feel secure, knowing their factories are safe and workers are protected from sudden disruptions, they will be more likely to invest.

Between July and January of FY25, LC opening for capital machinery fell by 33.68% to $1 billion, while LC settlements for capital machinery declined by 27.33% to $1.24 billion, according to the central bank data.

The country’s economy and banking system have slowed in recent years and the liquidity crisis in banks, worsened by rising defaulted loans, may intensify.

Private sector credit growth has been declining since November 2022, reaching 7.3% in December 2024, according to the Monetary Policy Statement (MPS) released on 10 February.

The slowdown is not solely due to policy rate hikes but stems from multiple factors, including slower deposit growth and increased government borrowing from commercial banks, which has crowded out private sector credit, it said.

Deposit growth dropped to 7.4% in December 2024 from 14.3% in March 2021, contributing primarily to the slowdown in overall credit expansion, it added.

According to the latest MPS, the central bank’s contractionary monetary policy, including a policy rate hike to 10 %, has pushed borrowing costs to nearly 15%, making loans prohibitively expensive for many businesses.

Additionally, several businesses have shut down due to political instability, legal issues tied to their associations with Hasina’s regime, and what some describe as an unfavourable business environment.

The banking sector’s ability to extend credit has also been severely impacted by rising defaulted loans, significant deposit withdrawals, and liquidity shortages.

Some banks have sought assistance from the central bank and larger institutions to meet daily cash demands.