Private sector credit growth in Bangladesh slows amid economic challenges

- Update Time : Monday, August 5, 2024

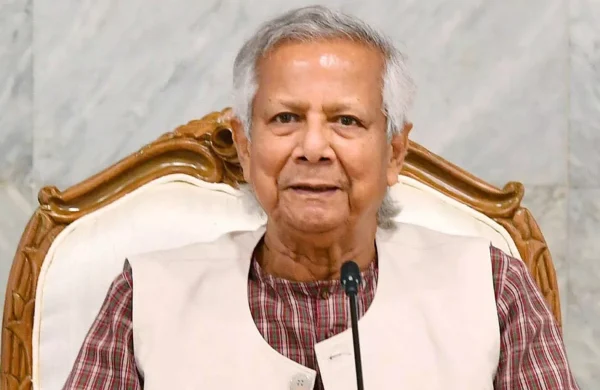

—Md Abdul Mannan—

Bangladesh’s private sector credit growth has seen a significant decline, with the Bangladesh Bank setting the target for the July-December 2024 period at 9.8%, down from 10% in the previous half-year. This adjustment reflects broader economic efforts to tackle persistent inflation and stabilize the financial system amid multiple domestic and international challenges.

In July 2023, private sector credit growth dropped to 9.82%, the lowest in 21 months, down from 10.57% in June 2023. This downturn is driven by a tight liquidity situation in the banking sector, reduced opening of letters of credit (LCs), foreign exchange market volatility, slow deposit growth, and weak loan recovery. The actual growth for the fiscal year ending June 2024 stood at 9.8%, mirroring the new target set for the next half-year.

The central bank’s monetary policy aims to reduce the credit flow to private businesses to combat inflation, which hit an 11-year high of 9.94% in May 2024 before slightly easing to 9.69% in July. The policy also aims to curb the current account deficits and stabilize the foreign exchange reserves, which have seen significant depletion.

Several factors contribute to this credit slowdown. A decline in the opening of LCs, especially for capital machinery and industrial raw materials, indicates a slowdown in industrial activities. According to Bangladesh Bank data, LC opening declined to $5.22 billion in February 2024 from $6.33 billion in January 2024 and $5.39 billion in December 2023. This decline signals reduced industrial production and a potential increase in overdue and forced loans, which occur when clients fail to meet their LC payment obligations.

The banking sector’s tight liquidity, driven by slow deposit growth and high exchange rates, further constrains its lending capacity. In June 2024, surplus liquidity in the banking sector fell to Tk 1,66,200 crore from Tk 2,03,435 crore the previous year. The central bank’s measures to contain money supply and inflation have also impacted credit growth. These include setting a lower credit growth target and maintaining policy rates despite the economic pressures.

This credit contraction poses significant challenges for Bangladesh’s economic growth. Reduced credit availability hampers businesses’ ability to invest and expand, affecting overall economic activity. The garments sector, a major contributor to the economy, faces reduced export orders due to global economic volatility, further dampening business confidence and investment.

It is a matter of concerns about the ongoing credit decline amid a growing economy. The necessity of maintaining a balance between controlling inflation and ensuring sufficient credit flow to support economic activities imperative.

Moreover, businesses face difficulties in importing raw materials and capital machinery due to the ongoing US dollar crisis, with many expansion projects being deferred. This situation, coupled with political uncertainties and recent anti-quota movement of students adds to the cautious stance of businesses and consumers, further dampening credit demand.

Analyzing the broader impacts: Inflation Control vs. Economic Growth: Balancing inflation control with economic stimulation is a delicate task. The Bangladesh Bank’s primary focus on curbing inflation by restricting credit growth aims to stabilize the economy. However, this restrictive monetary policy can also stifle economic expansion. Businesses rely on credit for investment in new projects, expansion, and operational continuity. When credit is tight, these activities slow down, impacting new job creation and economic dynamism.

Industrial slowdown: The significant drop in the opening of LCs highlights a broader industrial slowdown. Industries, particularly those relying on imported raw materials and machinery, are facing challenges due to the high cost of imports driven by the US dollar crisis. This slowdown is not just a symptom of reduced credit but also a cause for concern regarding the overall health of Bangladesh’s industrial sector.

Banking sector strain: The banking sector is under strain with reduced liquidity and slow deposit growth. Increase Non-Performing Loan (NPL), High exchange rates further exacerbate the issue, making it costly for banks to operate and lend. This strain is visible in the significant drop in surplus liquidity within the banking system. Measures to control the money supply and inflation, while necessary, have also constrained the banking sector’s ability to support economic growth through lending.

Impact on key sectors: Key sectors like the garment industry, which is a significant contributor to Bangladesh’s GDP and employment, are particularly vulnerable. Reduced export orders due to global economic conditions mean that even with available credit, there may be less demand for financing. This sector’s health is crucial, as it has a ripple effect on various other sectors, including retail, transport, and services.

Political and economic uncertainty: The political landscape, with recent anti- quota movement adds another layer of uncertainty. Businesses tend to adopt a cautious approach in politically volatile times, further reducing credit demand. Political stability is essential for economic confidence and investment. Any significant political upheaval can lead to prolonged economic uncertainty, affecting both domestic and international investor confidence.

Strategic considerations moving forward diversifying the economic base:To mitigate the impacts of credit slowdowns, Bangladesh might need to diversify its economic base. Reliance on a few key sectors makes the economy vulnerable to sector-specific downturns. Diversifying into technology, service industries, and higher-value manufacturing can provide new growth avenues and reduce dependence on traditional sectors.

Reforming and strengthening financial institutions can improve resilience. Policies to encourage deposit growth, reduce non-performing loans, and enhance the overall efficiency of the banking sector are crucial. A robust financial system can better weather economic shocks and support sustainable growth.

Improving export competitiveness can help mitigate the effects of global economic volatility. This could involve investing in higher-value products, improving supply chain efficiency, and negotiating better trade deals. Enhancing competitiveness can help sustain export orders, even in challenging global economic conditions.

Measures to stabilize the exchange rate can provide much-needed relief to businesses dependent on imports. This could involve using foreign exchange reserves strategically, improving foreign investment inflows, and maintaining a balanced trade policy. A stable exchange rate environment can reduce the cost pressures on businesses and support better planning and investment.

Coordinated policy efforts between monetary and fiscal authorities are essential. While the central bank focuses on controlling inflation and ensuring financial stability, fiscal policies should aim to stimulate growth through targeted investments in infrastructure, education, and technology. Coordinated efforts can ensure a balanced approach to managing inflation while promoting economic growth.

In conclusion it is to say Bangladesh’s economic scenario is at a critical juncture. The central bank’s measures to control inflation and stabilize the financial system are necessary but come with significant trade-offs. The challenge lies in balancing these measures with the need to support economic growth and development. Strategic diversification, strengthening financial institutions, enhancing export competitiveness, addressing exchange rate volatility, and ensuring coordinated policy efforts will be key to navigating these challenges. As Bangladesh moves forward, maintaining this balance will be crucial for sustainable economic growth and stability.

(The writer is a Senior Executive Vice President & Head of Credit, SBAC Bank PLC)