Rawhide loans fall short; only Tk 125cr disbursed of Tk 232cr target

- Update Time : Thursday, June 12, 2025

Staff Correspondent:

Bangladesh Bank’s initiative to inject Tk 232 crore into the leather sector for procuring rawhide during Eid-ul-Azha has fallen significantly short, with only Tk 125 crore disbursed to businesses, according to industry insiders.

Bankers cited a lack of interest among leather traders in taking out new loans as a reason for the shortfall, while the industry insiders highlighted a sharp rise in loan defaults, which has made banks more reluctant to extend credit to the sector.

As a result, tannery owners and seasonal leather suppliers have been unable to purchase sufficient quantities of rawhide during the peak Eid-ul-Azha season.

Stakeholders are now calling for easier loan terms and relaxed documentation requirements ahead of what is typically the country’s largest rawhide collection period.

Although nine banks initially approved Tk 232 crore in loans for rawhide procurement this year, only Tk 125 crore was disbursed, leading to a funding shortfall that entrepreneurs say has hampered both the collection and processing of rawhide.

According to sources, the Tk 125 crore disbursed this Eid season marked a steep decline from previous years — down from Tk 270 crore in 2024, Tk 259 crore in 2023, Tk 443 crore in 2022, Tk 735 crore in 2021 and Tk 1,800 crore in 2019.

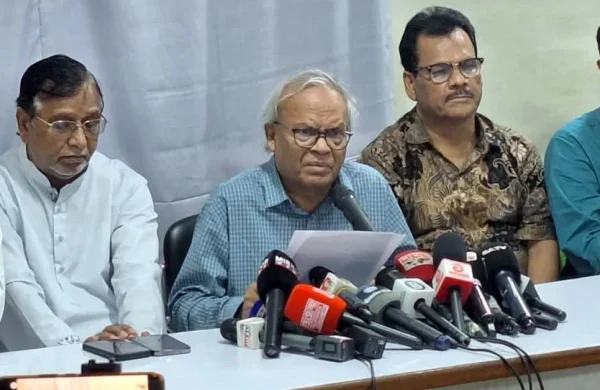

Md Shaheen Ahmed, Chairman of the Bangladesh Tanners Association (BTA), “Since leather is a perishable product, it needs to be collected and stored quickly. Cash is needed to buy leather collected from various warehouses across the country.

“For this, the warehouses collect leather from part-time traders during the Eid season. But even though tannery owners do business with their own capital throughout the year, special financing is needed for additional cash during Qurbani. This time, the banks had a demand of Tk 300–350 crore. They gave only Tk 125 crore, which is not enough,” he added.

He said with adequate cash loan support, problems in the leather sector could have been mitigated. “The poor and needy would have received cash from the leather. Foreign exchange income would have increased by exporting this,” he pointed out.

Bangladesh Bank Executive Director and Spokesperson Arif Hossain Khan said the target for lending to the leather sector this time was Tk 232 crore. “It is not possible to say before the bank opens how much loan will be waived in the end,” he said.

He also acknowledged that a segment of traders fail to repay borrowed funds, which has led to a significant rise in loan defaults in the sector. “If they ask for loans and don’t repay them, who will give them new loans? So they have to take loans with the mindset of repaying them. Otherwise, the crisis will not end,” he said.

According to Bangladesh Bank’s latest report, the outstanding loan balance in the leather industry stood at Tk 12,628 crore as of December 2024. Of this, Tk 4,844 crore has defaulted, accounting for 38 percent of total loans in the sector.

The Bangladesh Tanners Association (BTA) represents approximately 800 members, including tannery owners and commercial exporters. There are 1,866 large and medium-sized tanneries across the country.

Besides, many small tanneries collect leather from seasonal entrepreneurs during Eid-ul-Azha.

Tanner Anwar Hossain said while most rawhide is collected during Eid-ul-Azha, inadequate management leads to the wastage of roughly 30 percent each year.

The leather sector not only contributes to national growth and employment but also earned approximately $1.13 billion in foreign exchange during the last fiscal year, underscoring the need for focused attention and support.

Amjad Ali, a seasonal leather supplier, said, “Banks only give loans to tannery owners and exporters. They do not give loans to others involved in the raw leather business. If money had been received according to demand, the spoilage of leather could have been prevented.”