Regulatory actions against manipulations weigh on stocks

- Update Time : Sunday, December 15, 2024

TDS Desk

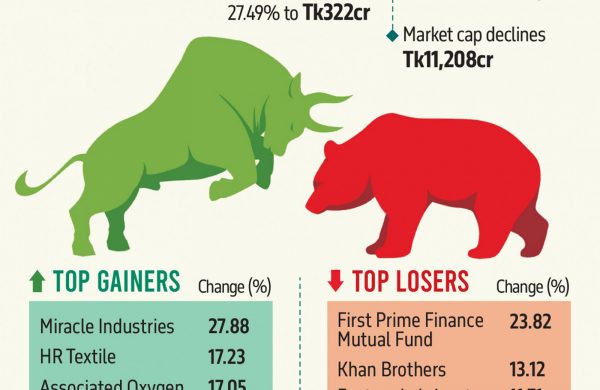

Stocks experienced a downward trend last week, with waning investor participation fuelled by repeated regulatory crackdowns on market manipulation.

The benchmark index declined throughout all trading sessions last week, with the DSEX, the key index of the Dhaka Stock Exchange (DSE), shedding 91 points to close at 5,105 – the lowest level in 46 days.

Similarly, the blue-chip index, DS30, plunged 30 points to settle at 1,881 over the week.

Investor participation in the market also slumped, with the average daily turnover shrinking by 27.5% to Tk322 crore, compared to Tk381 crore in the previous week.

Among the traded securities, 76 advanced, 293 declined, and 23 remained unchanged.

In its weekly market review, EBL Securities noted that the benchmark index of the capital bourse plunged into losing territory this week as investors grew anxious over the market’s momentum amid repeated regulatory actions against stock manipulations.

The market witnessed a continuous selling spree throughout the week, while news of the disbursement of the Tk3,000 crore sovereign-guaranteed loan to ICB failed to alleviate the prevailing pessimism on the trading floor, allowing the bears to take control of market momentum, the report added.

According to the Bangladesh Securities and Exchange Commission (BSEC), 18 individuals and institutions were fined Tk135 crore for manipulating shares of three companies listed on the stock exchange during a commission meeting held on Tuesday.

A senior official at a brokerage firm commented that, regardless of the market’s response, stock market manipulation must continue to incur substantial fines to serve as a strong deterrent and send a clear message to unethical investors operating in the market.

Saiful Islam, president of the DSE Brokers Association (DBA), told that , “Due to the continued slump in the stock market, both investors and intermediaries are very frustrated. We are not receiving any indication of hope regarding the market. There is no clear solution to escape this situation either.”

Saiful, who is also a director of BRAC EPL Stock Brokerage, further said in this scenario, government intervention is needed to improve the market.

“However, the government is not responding adequately. Since the interim government took charge, we have been demanding discussions with market intermediaries, but no response has been forthcoming,” he added.

When asked if there is a liquidity crisis in the market, the DBA president responded, “The bigger crisis in the stock market right now is a lack of confidence rather than a liquidity crisis. Currently, no one is willing to participate in the market due to this lack of confidence.”

He said the government is providing a loan of Tk3,000 crore to the Investment Corporation of Bangladesh (ICB) to support the market, but this is not a solution.

“Providing funds to the ICB benefits certain officials within the organisation, but it does not contribute to the development of the stock market,” he added.

When asked what should be done to overcome this situation, he said, “The government should sit with stakeholders and hold discussions. They need to implement long-term measures for market development. Only then can confidence in the market be restored.”

He further said it doesn’t seem like anyone is concerned about the market being in this situation. If there’s instability in the prices of basic commodities like potatoes, discussions are held with traders. However, even though the stock market has been experiencing a downturn for some time now, no one from the government is addressing it.

“If they [the government] had engaged with stakeholders, perhaps a solution could have been found by now. But they are not doing so,” he added.