VAT hike: Revenue boost or public burden?

- Update Time : Friday, January 3, 2025

TDS Desk

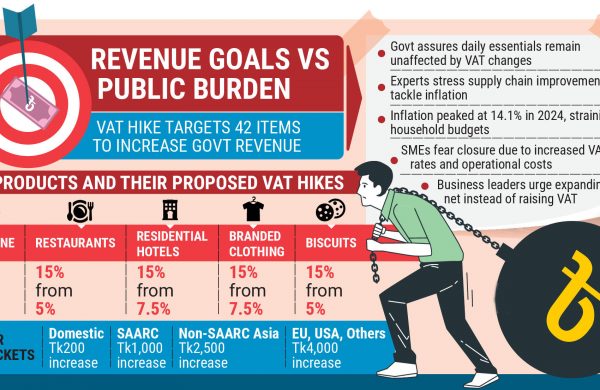

Families across the country are bracing for a potential increase in their living costs, while businesses express deep concerns about the government’s plan to hike Value Added Tax (VAT) on 42 goods and services.

The proposed increase has sparked widespread anxiety, with concerns mounting that the move will further strain household budgets, exacerbate inflationary pressures, and stifle economic growth.

However, Finance Adviser Dr Salehuddin Ahmed has assured the public that the proposed VAT increase will not adversely affect ordinary people.

He explained that the primary aim of this decision is to target high-income groups and increase government revenue, rather than succumbing to IMF demands. While minor price rises may occur in airline tickets and upscale restaurant bills, daily necessities will remain unaffected.

Experts agree that raising VAT on essential goods would have severely worsened inflation. They emphasise that the government should focus on addressing supply-side issues and enhancing domestic production.

Bangladesh’s foreign exchange reserve shortage has further complicated efforts to boost supply in international markets.

Dr Mostafizur Rahman, a fellow at the Centre for Policy Dialogue (CPD), stated that the government’s primary objective is revenue generation. He stressed that these measures must not place undue burdens on ordinary citizens.

Meanwhile, Dr Abdur Razzak, chairman of RAPID, argued that effective supply-side interventions are crucial to resolving economic challenges. With low foreign exchange reserves making international market expansion difficult, enhancing domestic production is essential to fill the gap.

Despite efforts to stabilise the economy through monetary policy, experts warn that sustainable improvement requires addressing supply chain inefficiencies. Increasing supply and production is critical to easing public pressure and fostering economic recovery.

INFLATION PRESSURES HIT HOUSEHOLDS HARD

Inflation has taken a toll on Bangladeshi households, with food prices soaring and essential items becoming unaffordable for many. In July 2024, food inflation reached a 16-year high of 14.1%. Although officials claim progress in controlling inflation, the average rate has risen to 10.27%, with food prices increasing by nearly 20%.

According to economists, persistent inflation has eroded workers’ earnings despite incremental wage increases.

For 34 consecutive months, wage growth has lagged behind inflation. In November, inflation stood at 11.38%, while wages grew by only 8.1%, according to the Bangladesh Bureau of Statistics (BBS).

Workers continue to face mounting challenges as their purchasing power diminishes.

‘VAT HIKE A THREAT TO SMES’

The proposed VAT hike has drawn criticism from various business leaders.

Speaking to this correspondent, Taskeen Ahmed, president of the Dhaka Chamber of Commerce & Industry (DCCI), expressed concerns over the National Board of Revenue’s (NBR) plan to increase VAT and excise duties across multiple sectors.

“Doubling VAT rates for non-AC hotels and clothing items, among others, will significantly raise operational costs,” Ahmed explained. “This will inevitably be passed on to consumers, triggering inflation and reducing purchasing power.”

Higher supplementary duties on essential imports, such as soap, detergent, and paint, alongside increased excise duties on air tickets, are expected to further burden businesses and households.

Taskeen Ahmed urged the government to adopt a balanced approach that promotes revenue growth without undermining business sustainability or worsening inflationary pressures.

Mohammed Sohel, managing director of Bangla Poshak Limited, warned that raising VAT from 4% to 15% for businesses with sales exceeding Tk50 lakh could devastate small and medium-sized enterprises (SMEs).

“This decision will harm both the business community and consumers, especially non-bonded businesses not involved in direct exports,” he said.

Sohel recommended that the government engage in discussions with business leaders before implementing such measures.

Mahmudur Rashid, Managing Director of Grasshopper Group, predicted a sharp decline in sales if VAT rates are increased.

“Instead of raising VAT, the government should focus on expanding the tax net and addressing tax evasion,” Rashid suggested.

“Industries are already grappling with challenges like the dollar crisis and high inflation; further VAT increases will discourage entrepreneurship.”

Mizanur Rahman, chairman of Exim Pack Ltd, echoed these concerns, stating that many small businesses may be forced to shut down due to rising operational costs.

“Hiking VAT will discourage young entrepreneurs and stifle job creation in the country,” he concluded.

NBR TO ENFORCE INCREASED VAT BY 5 JANUARY

The National Board of Revenue (NBR) plans to increase VAT rates to as high as 15% on 42 items by 5 January to meet IMF conditions for boosting revenue collection. A senior NBR official confirmed that the amended VAT law is awaiting approval from the law ministry and is expected to be implemented soon.

The targeted items include air tickets, medicines, restaurants, residential hotels, sweetmeats, biscuits, and branded clothing. According to preliminary estimates, VAT on medicines at the trading stage may rise from 2.4% to 3%, while VAT on restaurant bills and residential hotel stays could increase from 5% to 15%.

Other proposed measures include raising supplementary duty on cigarettes from 66% to 67% and increasing excise duties on air tickets. For example, domestic air ticket excise duty may rise by Tk200, while excise duties for SAARC countries could increase to Tk1,000. For non-SAARC Asian countries, the duty may climb to Tk2,500, and for the EU, USA, and other regions, it could rise to Tk4,000. However, excise duties for Hajj passengers will remain waived