S Alam siphons off Tk15,000cr from SIBL

- Update Time : Monday, August 19, 2024

TDS Desk:

S Alam Group, a business conglomerate with close ties to the former Awami League government, has allegedly siphoned off approximately Tk15,000 crore from Social Islami Bank Limited (SIBL) in the past seven and a half years.

Now, the bank’s several former top officials who were forced to leave the bank, have called for the dissolution of the bank’s current board under the Bank Company Act.

They also urged the Bangladesh Bank to form a new SIBL board comprised of the bank’s former board directors or financial experts.

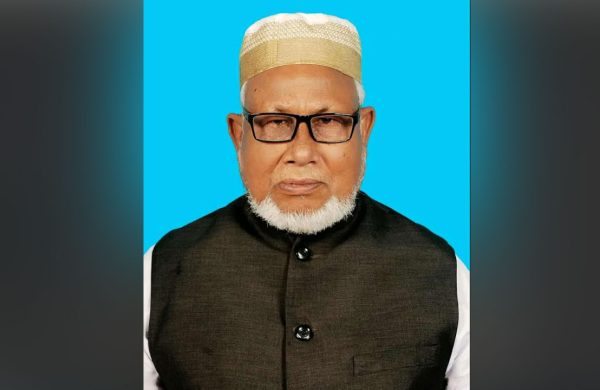

On Sunday, a letter signed by three former SIBL shareholders— former chairman Rezaul Haque, former executive committee chairman Anisul Huq and former audit committee chairman Abdur Rahman—was submitted to the governor of the central bank.

The letter claims that in 2017, the bank’s top officials were forced to resign under duress by an intelligence agency, allegedly at gunpoint. The current board, according to the petition, is primarily focused on money laundering and bank looting, neglecting the interests of depositors and the security of their funds.

The letter further alleges that SIBL recently disbursed Tk15,000 crore in loans, much of which was illicitly withdrawn by S Alam Group and their associates, using both direct and proxy means.

The bank is reportedly teetering on the brink of insolvency due to rampant corruption, causing widespread dissatisfaction among depositors, many of whom have begun withdrawing their funds, the letter read.

In 2017, S Alam Group had taken over the control of SIBL, with Belal Ahmed, the son-in-law of the group’s head Saiful Alam, currently serving as chairman.

The letter recounts how, on 30 October 2017, under the supervision of a special security force, S Alam Group and their associates allegedly coerced key bank officials to resign during a board meeting held at the Westin Hotel in Gulshan, instead of the bank’s head office in Motijheel.

The bank’s former chairman Rezaul Haque told that, “On 30 October 2017, I received a call instructing me to go to the Directorate General of Forces Intelligence (DGFI) headquarters in Kochukhet. I initially refused, explaining that I had a meeting scheduled at 2:30pm. However, they insisted, assuring me that I would be released before the meeting.”

“When I arrived, my mobile phone was confiscated, and I was taken to a room on the third floor. A brigadier then approached me and asked me to sign a document stating that I was voluntarily resigning from my positions as director and chairman of SIBL Bank,” he added.

“The intelligence agency had summoned the bank’s managing director and vice-chairman as well, where they were forced to sign their resignation letters. Following this, I met with Saiful Alam (S Alam), his brother Abdus Samad Labu, and Belal Ahmed. Later, the then director general of that agency Saiful Abedin informed me that the ownership change was directed from higher authorities. Since then, the bank has been driven to the brink of destruction, which is why we have demanded a swift restructuring of the board,” Rezaul Haque stated.

The letter submitted to the banking regulator demands the immediate dissolution of the current board, citing the disbursement of thousands of crores in loans to S Alam Group and its associates, which has placed the bank in an existential crisis.

The non-performing loans of SIBL reportedly exceeded Tk9,000 crore, with funds continuing to be withdrawn by the group through special arrangements.

The letter also highlights the growing deficit in the bank’s central account with the Bangladesh Bank due to the ongoing withdrawal of customer deposits. Additionally, the exclusive recruitment of people from Chattogram’s Patiya caused widespread dissatisfaction among the bank’s staff.

The petitioners warn that the owners of S Alam Group, along with corrupt board members of SIBL, have gone into hiding but still continue to distribute loans under the guidance of the bank’s top management.

They demand the swift removal of all corrupt officials, including the MD and DMD of the lender, to restore stability to the bank.

Meanwhile, panic among depositors led to a rush of withdrawals, with many customers opting to collect pay orders to circumvent withdrawal limits. On Sunday alone, SIBL branches issued pay orders totaling Tk8.17 crore.