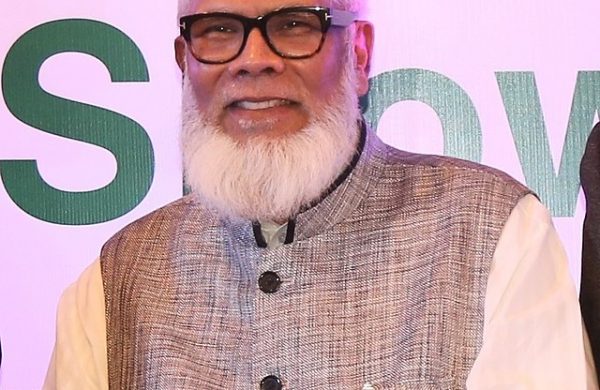

Salman F Rahman: The mastermind of looting

- Update Time : Monday, August 19, 2024

TDS Desk:

Salman F Rahman, who served as an adviser to deposed Prime Minister Sheikh Hasina, has allegedly looted Tk570 billion from seven commercial banks and other entities abusing power over the last 15 years.

Of the total amount, he took Tk370 billion from the seven commercial banks and embezzled around Tk200 billion from unknown sources, according to confession during interrogation by law enforcement agencies.

Sources said Salman F Rahman, the private industry and investment adviser to former PM Hasina, worked as the mastermind behind corrupting the entire financial sector, including the country’s banking sector, capital market and bond market.

Emerging as a defaulter in the banking sector, he abused power and looted the investors in the capital market. It has been known that the name of Salman F Rahman was discussed for the last 15 years as one of the masterminds of the scams in the stock market and banking sector. However, his scam began much earlier.

His organisations have taken loans worth Tk368.65 billion from seven public and private banks while Tk237 billion pulled out from a single lender. There are also complaints against his companies of not bringing money to the country by exporting products. Salman has allegedly raised Tk650 billion from the stock market.

He also grabbed another Tk200 billion public fund from an anonymous source. The central bank has changed the policy to reschedule the loans of several banks.

Beximco Group owned by the family of Salman F Rahman, borrowed around Tk237 billion from the state-owned Janata Bank violating the regulations related to the single borrower exposure.

The group is also liable to Sonali Bank for a Tk18.38 billion loan, Tk9.65 billion at Rupali Bank, Tk14.09 billion at Agrani Bank, Tk29.52 billion at National Bank, Tk60.31 billion at IFIC Bank and Tk6.05 billion at AB Bank. As the chairman of IFIC Bank, Salman F Rahman pulled out over Tk110 billion from the private lender for expanding personal businesses.

IFIC Bank’s top borrowers include Sreepur Township Limited with a loan amount of Tk12 billion, Sunstar Business Tk6.15 billion, Fareast Business Tk6.14 billion, Cosmos Commodities Tk6.12 billion and Uttara Jute Fibers Tk5.52 billion. Absolute Construction and Engineering Tk4.63 billion, Apollo Trade International Tk4.55 billion, Ultron Trading Limited Tk4.49 billion and Northstone Construction with Tk4.21 billion.

Apart from this, a loan of Tk426 crore has been taken from IFIC Bank in the name of Asad Trading and Engineering Limited and more than Tk400 crore in the name of Serv Construction.

Then Finance Secretary Abdur Rauf Talukder directed Bangladesh Infrastructure Finance Fund Limited Chief Executive Officer Formanul Islam to invest US$185 million in the 200MW Teesta Solar Power Project of Salman F Rahman.

Formanul Islam was forced to resign when he told the finance secretary about the funding crisis. Later, the Teesta Solar Power Project received Tk1 billion from the JICA fund.

“Salman F Rahman is associated with all the companies. Salman F Rahman’s name comes first in the share market manipulation. He manipulated shares by naming different companies under different names,” said an official of Bangladesh Bank, requesting not to be named.

This influential business leader of Awami League did not face punishment even though his name appeared in the reports of the investigation committees formed at different times. An example of Salman F Rahman’s manipulation is GMG Airlines.

Salman F Rahman, a name behind the share market scam in 2010, pulled about Tk4 billion in public funds from the market while the influential leader took a loan from Sonali Bank worth Tk2.5 billion. He manipulated the company’s financial reports and inflated profits to lure investment into the company.

In the share market scam, he showed a loss-making company, GMG, as profitable to lure people into investing around Tk800 million. But after withdrawing money from investors, the picture of the company’s plight emerged.

Eventually, the company was shut down and the investors did not get a single penny back. Sonali Bank did not get the loan back. Later, the state-owned lender took the initiative to auction the property of GMG Airlines. But the auction was suspended by the High Court.

In 1990, Salman F Rahman raised around Tk1 billion through four ventures. By issuing Sukuk bonds in 2021, Beximco Group raised about Tk300 billion from various banks, financial institutions, insurance companies and general investors.

As the banks were not willing to invest in Sukuk bonds, they were pressured by Bangladesh Bank in various ways to do so.

Salman F Rahman forced Bangladesh Bank to change its circular to invest in these bonds. In 2020, the fund was formed to support each bank by Tk2 billion only on the condition of investment in the capital market.

He forced the banks to invest this money in Sukuk while Bangladesh Bank issued a circular saying banks can invest this money in Islamic bonds as well.

Banks selling shares and buying bonds have a negative impact on the capital market. In a span of just six months, the price index of the Dhaka Stock Exchange dropped by about 1,200 points. After the Sukuk, Salman F Rahman’s firm was allowed to issue a bond worth Tk10 billion again.

IFIC Bank was used to withdraw this amount in the name of Sreepur Township in the name of IFIC Amaar Bond where the lender acts as guarantor. Bangladesh Bank and Bangladesh Securities Exchange Commission have not taken any action against Beximco amid various criticisms regarding the bank’s use of depositors’ money to benefit its own company. Apart from this, the issuance of zero coupons for withdrawing Tk15 billion was allowed in April.

Salman F Rahman once again started exerting pressure on various banks to buy these bonds. It has been learnt that in 2010, the name of Salman F Rahman came up in the report of the investigation committee formed led by former BB Deputy Governor Khondkar Ibrahim Khaled.

In mid-2006, Salman F Rahman tried to occupy state-owned Rupali Bank. Participating in the tender, Saudi Prince Bandar bin Muhammad Abdul Rahman Al Saud offered US$450 million for 93% of the shares of Rupali Bank. Salman bought each share of Rupali Bank for Tk400 before the trading began. Later, it was learnt that there is no Saudi prince by this name.

A person is disguised as a fake Saudi prince and a drama is arranged to buy the Rupali Bank. Then the share price of Rupali Bank increased to Tk3,400 and Salman looted Tk9 billion from the state-owned bank through fraudulence.