Savings certificate interest rates rising from Jan 1 last

- Update Time : Thursday, January 9, 2025

TDS Desk:

The interim government is set to hike the interest rates for savings certificates effective from January 1 last, with increases of at least one percentage point.

Investors with deposits of Tk7.5 lakh or less will receive slightly higher returns.

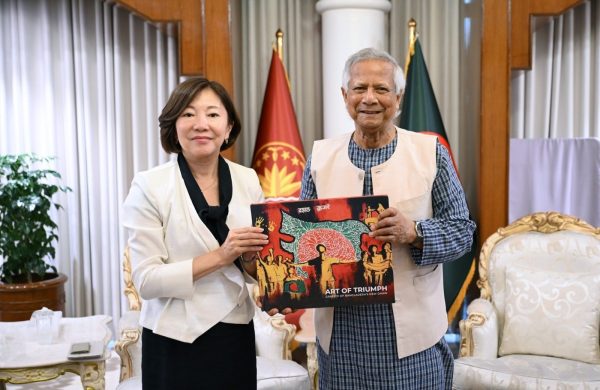

According to finance ministry sources, Chief Adviser Prof Muhammad Yunus has approved a proposal to re-fix the interest rates for savings certificates. The Internal Resources Division of the finance ministry will soon issue an official notification.

Finance ministry officials said the rates have been set for the six months until June.

Under the adjustment, investors with up to Tk7.5 lakh in the five-year Bangladesh Savings Certificate will receive an interest rate of 12.40%. For investments exceeding the amount, the rate will be 12.37%. Currently, the interest rate for the scheme stands at 11.28%.

For the three-year Quarterly Profit Savings Certificate, the prospective interest rate for investments up to Tk7.5 lakh is set at 12.30%, while investments exceeding the amount will earn 12.25%. Currently, the scheme offers an interest rate of 11.04%.

The five-year Pensioner Savings Certificate will offer 12.55% for investments up to Tk7.5 lakh and 12.37% for higher investments. The interest rate under the scheme currently stands at 11.76%.

For the five-year Family Savings Certificate, the interest rate will be 12.50% for investments up to Tk7.5 lakh, while investments exceeding this amount will earn 12.37%. Currently, the scheme offers an interest rate of 11.52%.

Additionally, for the three-year Post Office Fixed Deposit, the interest rate will be 12.30% for investments up to Tk7.5 lakh, and 12.25% for investments above the amount.

Banks are currently offering interest rates of 9% to 11% on fixed deposits. In comparison, savings certificates currently offer returns between 11% and 11.5%.

Previously, savings certificates offered significantly higher returns than bank deposits. The increase in the interest rates for savings certificates is aimed at aligning them more closely with bank deposit rates, said the officials.

In recent years, the government has reduced its reliance on savings certificates to bridge budget deficits. The IMF also advocated for lowering the interest burden on the government from savings certificates.

However, with declining revenue collection and a reduced focus on borrowing from the banking sector, the government is once again leaning towards borrowing through savings certificates.

In the fiscal year 2022-23, the net borrowing from savings certificates was negative, amounting to Tk3,347 crore. The original budget for the fiscal year set a target of Tk18,000 crore in net borrowing from savings certificates. However, the revised budget adjusted this target to a negative Tk7,310 crore.

For the current fiscal year, the government has significantly increased the target, aiming to borrow Tk15,400 crore from the sector.