S&P Global retains BD banking sector in high-risk category

- Update Time : Thursday, July 17, 2025

TDS Desk:

S&P Global Ratings, one of the world’s three major credit rating agencies, has retained Bangladesh’s banking sector in one of its highest risk categories in its midyear Banking Industry Country Risk Assessment (BICRA).

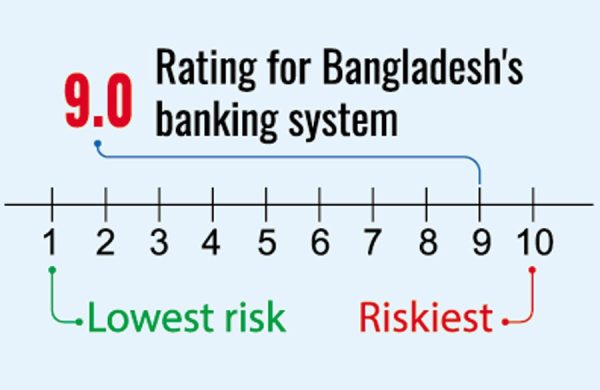

In its latest report released on July 16, the global agency rated Bangladesh’s banking system at 9.0 on a scale of 1.0 to 10, where 1.0 denotes the lowest risk and 10 the highest. This places the country’s banking industry among the riskiest in Asia and the Pacific region – a position shared with only three other Asia-Pacific economies: Mongolia, Cambodia, and Vietnam.

The BICRA framework assesses countries across eight risk factors, including economic risk trends, industry risk trends, economic imbalances, credit risk, institutional framework, competitive dynamics, and system-wide funding.

According to S&P, the rating reflects elevated economic and institutional vulnerabilities, worsened by governance failures in some Shariah-based banks, which had faced liquidity and management crises.

In late 2023 and early 2024, Bangladesh Bank intervened in at least four Islamic banks amid allegations of insider lending, liquidity mismatches, and fraudulent transactions. In response, the central bank restructured their boards, suspended top officials, and injected emergency liquidity.

“We are committed to ensuring stability in the banking system. Our interventions in several Shariah-based banks were necessary to restore depositor confidence and enforce regulatory compliance,” a senior official of Bangladesh Bank told the FE. He said some banks are showing positive trends.

Despite these challenges, Bangladesh received a ‘stable’ outlook in the ‘economic risk trend’ sub-indicator. The industry performed comparatively better in “economic imbalances” and “system-wide funding.” However, it highlighted poor scores in areas such as credit risk, competitive dynamics, and the institutional framework.

In contrast, Singapore, Australia, and Hong Kong of the Asia and the Pacific region were rated at 2.0, indicating strong and stable banking environments. Japan and South Korea followed closely with a BICRA score of 3.0.

Even as systemic risks persist, local bankers expressed cautious optimism about the sector’s recovery.

Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank, a leading private commercial bank, said the central bank’s recent oversight has contributed to a more stable foreign exchange market, healthier deposit growth, and steady remittance inflows.

“The central bank has been guiding us through a difficult path inherited from years of unchecked banking practices. Deposit growth is now showing strength, and remittance inflows remain robust,” he said.

However, Rahman underscored the urgent need to stimulate investment to spur economic growth. “Our investment levels have remained subdued. Without a significant boost in private sector investment, economic activity and job creation will continue to lag,” he added.

On the other hand, economists say that while recent reforms are promising, lasting improvement depends on structural overhauls-especially in addressing non-performing loans (NPLs), corporate governance gaps, and political influence that have long plagued the sector, particularly during the 16-year rule of the Awami League-led government.