Taskforce finds S Alam operates 18 shell firms in British Virgin Islands

- Update Time : Friday, November 22, 2024

TDS Desk

Controversial Bangladeshi conglomerate S Alam Group has been found to hold substantial investments in the British Virgin Islands (BVI), a well known tax haven and base for shell companies.

According to investigators looking into laundering allegations against the group, its Chairman Saiful Alam Masud has established 18 shell companies – typically used for money laundering – in the BVI between 2011 and August 2024, without the required approval from Bangladesh’s central bank.

This revelation comes as Bangladesh intensifies its crackdown on corruption and financial crimes committed by influential figures including S Alam who had close ties with the recently fallen Awami League government that ruled the country for over 15 years, starting in 2009.

On 17 November, the interim government’s Chief Adviser Muhammad Yunus announced that a list of 150 influential individuals suspected of corruption and money laundering had been compiled with investigations already underway for 79 of them.

Just days earlier, Bangladesh Bank Governor Ahsan H Mansur said efforts to recover laundered assets were progressing. “The net has been cast, and now it is just a matter of reeling it in.”

A member of the taskforce involved in these efforts informed REPORTERS that the discovery of S Alam’s BVI holdings was a direct result of the government’s focused determination to trace and recover laundered assets.

The official, speaking on condition of anonymity, described the findings as “a significant breakthrough” in the ongoing investigation.

In late October, BB Governor Mansur said tycoons connected to the ousted AL regime had syphoned around $17 billion from the banking sector, with S Alam alone taking at least $10 billion.

ALL-OUT EFFORTS NEEDED

Birupaksha Paul, a professor of economics at the State University of New York and a former chief economist of the Bangladesh Bank, told REPORTERS that two businessmen – S Alam and Salman F Rahman – are responsible for destroying Bangladesh’s banking sector, with the previous government playing a key role in this.

“The governor said S Alam alone laundered $10 billion abroad. The government should make every effort to repatriate these funds, including initiating government-to-government talks, particularly with Singapore, to facilitate the return of assets held by S Alam there,” he said.

The group reportedly has significant investments in Singapore, Malaysia, Cyprus, and Europe.

However, he cautioned that while the process is long, legal avenues could take years, and political changes with upcoming elections may complicate matters. “These business groups may also coordinate with the next elected government to safeguard their interests.”

During a taskforce meeting on 19 November, details of the overseas assets held by S Alam and other groups were highlighted, according to sources from both domestic and international organisations collaborating with the taskforce.

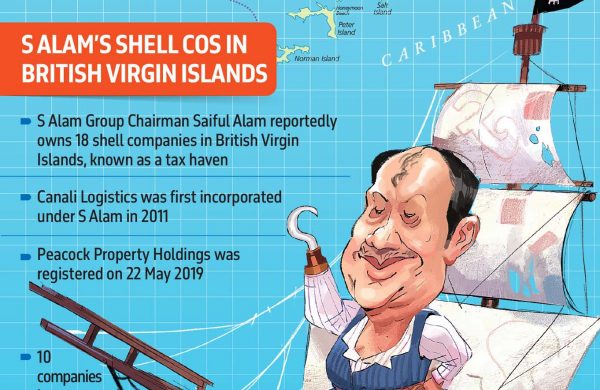

S ALAM’S SHELL COMPANIES IN BVI

In the British Virgin Islands, Canali Logistics Pte Ltd was first incorporated under S Alam’s name in 2011, , according to the taskforce source.

Ten more companies were incorporated under S Alam from 2016 to 2020. They are – Honeywell International Pte Ltd, Golden Trails International Pte Ltd, Hamilton International Pte Ltd, Hazel International Pte Ltd, Livonia Pte Ltd, Lu Shui International Pte Ltd, Pittsdale International Pte Ltd, Springfield International Pte Ltd, Qing Shui International Pte Ltd and Trivoli Trading Pte Ltd.

Additionally, six more companies were incorporated from 2021 to August 2024. They are – Adair International Pte Ltd, Greenwich International Pte Ltd, Linear International Pte Ltd, Marico International Pte Ltd, Wavepac International Pte Ltd, and Zenita International Pte Ltd.

Furthermore, a company named Peacock Property Holdings Limited was incorporated under S Alam’s name on 22 May 2019.

In the case of Hazel International Pte Ltd, 70% of the shares are held by Saiful Alam, with the remaining 30% owned by his wife, Farzana Parvin.

Any Bangladeshi individual or institution must seek approval from the central bank before investing abroad. The S Alam Group was not granted such permission, sources said.

The 2017 Paradise Papers leak exposed the offshore dealings of some of the world’s most powerful people and corporations, bringing the British Virgin Islands into the spotlight as a well-known tax haven.

Located more than 17,000 kilometres away from Singapore, this territory offers significant tax advantages, including no income tax, corporate tax, or capital gains tax. Additionally, it provides privacy rights, allowing companies to operate without publicly disclosing the names of their shareholders or directors on official documents.

WHY USE TAX HAVENS?

Shell companies, often established to hold assets or facilitate transactions with minimal operational activity, thrive in tax havens due to low taxes, confidentiality, and lax regulations. Popular jurisdictions like the Cayman Islands, British Virgin Islands, Bermuda, and the Channel Islands attract businesses and individuals seeking secrecy and tax advantages.

Investigations by the International Consortium of Investigative Journalists (ICIJ) reveal widespread exploitation of these havens. The findings highlight how shell companies are used to evade taxes, launder money, and obscure ownership, leveraging regulatory loopholes for financial gains.

REPATRIATING FUNDS DIFFICULT BUT CAN BE DONE

Dr Iftekharuzzaman, executive director of Transparency International Bangladesh, told REPORTERS that The Bangladesh Bank and Bangladesh Financial Intelligence Unit (BFIU) must have documented evidence to prove that the money was laundered, as they were involved.

“While recovering laundered funds is not impossible, it is a complex and lengthy process,” he said.

He said that it must be legally established that S Alam’s companies in BVI are funded by money laundered from Bangladesh. “Though it is often claimed to be smuggled money, no country will return it unless legally proven,” he added. “Once established, diplomatic efforts with those countries should follow.”

For that, Iftekharuzzaman stressed the need for coordination among five key agencies: BFIU, the Anti-Corruption Commission (ACC), the Criminal Investigation Department (CID), the National Board of Revenue (NBR), and the Attorney General’s Office.

S ALAM’S OTHER OVERSEAS HOLDINGS

S Alam reportedly began building his business empire in Singapore starting in 2009 with registering multiple companies under his own and his wife’s names.

A recent investigation by reporters revealed that the group invested around $700 million (around Tk6,300 crore) to acquire three hotels and retail space in a shopping mall in Singapore.

Earlier reports suggested that S Alam has built a business empire worth at least $1 billion in Singapore.

According to confidential documents from Bangladesh Bank, S Alam is alleged to have embezzled nearly Tk2 lakh crore from Bangladesh through fraudulent loans.

These loans were channelled via fake documents and laundered abroad through various import-export companies, as revealed by sources within Bangladesh’s Central Bank and the Financial Intelligence Unit.