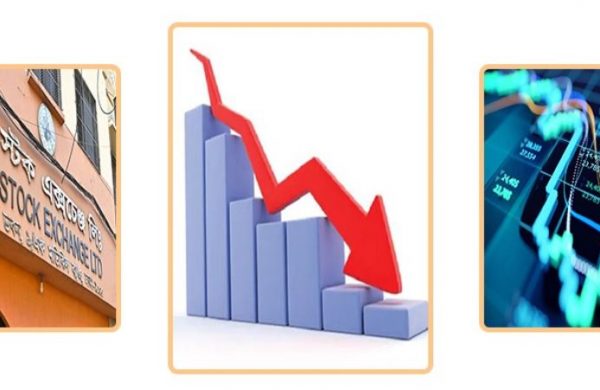

The reason behind continuous price falls in stock market

- Update Time : Tuesday, April 2, 2024

Desk Report:

Falls in price in the stock market have become a regular incident. The country’s stock market has been going down continuously for more than a month. In just one and a half months (48 working days), investors in the Dhaka Stock Exchange (DSC), the main bourse of the country, have lost more than Tk 1 lakh 10 thousand crores.

This information of the downtrend has been obtained by considering the market value of securities listed in the Dhaka Stock Exchange (DSE) from January 18 to April 1. During this time, the total transaction was 48 days.

Based on the market value of listed companies, bonds, and mutual funds, DSE said that the market capitalization was Tk 7, 87,905 crore on January 18. On April 1, it decreased to 6,77,674 crore taka. In other words, in 48 days, all listed securities lost market value of Tk 1,10, 231 crore.

When the falling trend started in stock market-

After the minimum price level or floor price of the share price is removed, the stock market starts to fall. From January 21, the capital market regulatory body Bangladesh Securities and Exchange Commission (BSEC) lifted the floor price in several steps. After that, the share price increased in the market for a few days. However, from the middle of February, the prices started to fall continuously. Earlier, the last phase of floor price was imposed in July 2022 to prevent the fall of the stock market.

In the last three months (January 1 to April 1), there were a total of 61 trading days in the stock market. Out of these, the index has fallen on 32 days. And the index increased by 29 days.

Investors are leaving the capital market-

Investors are leaving the stock market in fear of continuous price falls. Fearing that the price may fall further, many people are selling shares even at a loss.

According to CDBL data, the number of shareless BO accounts on March 18 was 3, 19, 649. At the end of April 1, which increased to 3,53,492. That is, within 10 working days, 33,843 investors have sold all their shares as BO.

Why is the price dropping?

Market analysts say that the long-term floor price has created a multifaceted crisis for the market. At this time, foreign investors have lost confidence in this market, on the other hand, uncertainty has also been created among the country’s investors. Besides, there is a shortage of cash in the banking sector. Due to these reasons, the market is continuously falling in price.

BSEC executive director Mohammad Rezaul Karim said, we want to let the market move at the speed of the market. At the level that the market has fallen, we hope that the market will turn around again soon on its own strength. Because the share price of many good companies has fallen to undervalued levels.

Market people say that on the one hand, the share price of good companies is falling, on the other hand, the share price of bad companies is being increased through manipulation. This is also one of the major reasons why good investors are losing interest in the market. The share prices of some infamous companies have risen abnormally over the years, but the regulatory body has not taken any effective action against them.

Meanwhile, yesterday (Monday), the working day ended with a big fall in the indices of DSE and CSE. However, despite the increase in transactions in DSE, it has decreased in CSE.

All indices fell on DSE on Monday. The main index of DSE ‘DSEX’ was down by 29.23 points to 5,800 points till 11:30 am on Monday (April 1). The other index ‘DSES’ decreased by 6.56 points to 1259 points and the ‘DS30’ index decreased by 9.78 points to 2011 points respectively.

However, the volume of transactions has increased in DSE on this day. Shares worth Tk 468 crore 82 lakh were traded on this day. Whereas shares of Tk 467 crore were traded on the last working day. The transaction increased by 1 crore 82 lakh taka.