Tk 20,000cr savings ahead: BB drives push for a ‘less cash’ economy

- Update Time : Wednesday, October 29, 2025

Staff Correspondent:

The dominance of cash transactions in Bangladesh continues despite rapid technological advancement in the financial sector.

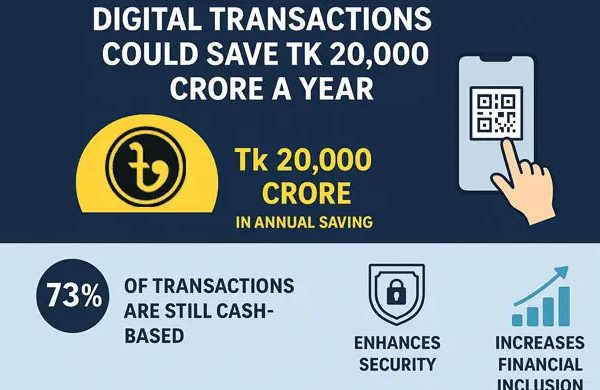

According to Bangladesh Bank, about 73 per cent of all transactions in the country are still made using cash.

However, moving toward a more digital or ‘less cash’ economy could potentially save the nation around Tk 20,000 crore annually, a figure equivalent to the total cost currently spent on printing, transporting, storing, and securing cash.

THE HIGH COST OF CASH

Bangladesh Bank officials say that maintaining a cash-based economy places a heavy financial burden on the state. Every year, the central bank prints a massive volume of notes through the Security Printing Corporation in Gazipur.

The short life span of paper notes, typically six to eight months, means they must be frequently replaced. Coins, though more durable, are costly to produce and circulate.

Governor Ahsan H Mansur, at a recent event organised by the Centre for Policy Dialogue (CPD), said, “Around Tk 20,000 crore is spent annually on the printing, storage, transportation, and distribution of currency notes. If we can reduce the public’s dependency on cash, we can redirect this massive expense toward development sectors such as health, education, and infrastructure.”

Bangladesh Bank has already initiated policy reforms to promote QR code–based transactions, ensuring all licensed institutions adopt this digital payment system. The aim is to make payments faster, safer, and more transparent while minimizing operational costs across both the public and private sectors.

RELUCTANCE TO GO CASHLESS

Despite strong efforts from the government and regulators, public acceptance of digital payments remains sluggish.

The central bank launched ‘Bangla QR’ in January 2023, a system that allows interoperable QR payments across banks and mobile financial service (MFS) providers.

Yet, even in commercial hubs such as Motijheel, QR codes are often seen gathering dust at small shops.

Restaurant owner Hasan Ali said, “Digital transactions make it easier to track revenue, which means higher taxes. Many traders therefore prefer cash to underreport turnover.”

Another trader, Raihan Hossain, added, “Customers often don’t know how to use QR codes. They’re used to paying cash, it feels more convenient.”

Consumers share similar reservations. Salma Khan, a resident of Moghbazar, said, “I’m willing to pay digitally, but most local stores still insist on cash. It’s not easy to go cashless when the infrastructure isn’t ready everywhere.”

Meanwhile, ride-share driver Manjur Hossain noted, “I have a bank account, but many of my customers don’t use digital wallets. For now, cash just feels safer.”

These statements reflect a broader social challenge. the mindset barrier, that policymakers must address before a cashless society can truly emerge.

EXPERTS CALL FOR AWARENESS AND SECURITY

Experts agree that technological literacy and trust are crucial for digital payment adoption.

Helal Ahmed Joni, research director at Change Initiative, said, “Security and awareness must go hand in hand. People need to feel confident that digital transactions are not only convenient but also safe and reliable.”

Recent incidents have amplified these concerns. A fraud ring recently targeted Standard Chartered Bank customers, stealing funds from their credit cards.

Cybersecurity expert Abdul Alim warned that as digital transactions increase, so do cyber threats. “Robust cybersecurity measures and user education are essential. Without them, even the best technology can backfire.”

Bangladesh Bank’s Executive Director Arif Hossain Khan echoed the sentiment: “Investing in cybersecurity should be seen not as a cost but as a long-term investment. Trust is the foundation of any digital economy.”

DIGITAL BANKING ON THE HORIZON

To further accelerate digital transformation, Bangladesh Bank has approved a new framework for digital banks, with plans to issue licenses soon.

KEY FEATURES INCLUDE:

Minimum paid-up capital: Tk 300 crore which was earlier Tk 125 crore.

No physical branches or over-the-counter (OTC) services, all operations via mobile apps and online platforms.

Transactions through virtual cards and QR codes, eliminating plastic card issuance.

Focus on small borrowers and micro-entrepreneurs, excluding large and medium enterprises. Mandatory stock market listing (IPO) within five years.

This move aims to extend formal financial services to the unbanked population, especially in rural areas, while lowering operational costs through technology.

THE ECONOMIC PAYOFF

If successful, the shift toward digital payments could yield multiple benefits:

Savings of up to Tk 20,000 crore annually in government expenditure. Longer lifespan of notes and reduced demand for printing new currency.

Enhanced financial inclusion, as more people access formal banking services. Greater tax transparency, aiding revenue collection.

Boosted productivity and consumer convenience, through faster and traceable transactions.

THE ROAD AHEAD

Bangladesh’s journey toward a ‘less cash’ society is gradual but inevitable. The central bank’s initiatives — from promoting QR payments to enabling digital banks — lay the foundation for a modern, efficient financial system. However, experts caution that technology alone cannot drive change.

As Arif Hossain Khan aptly summarised, “Building a digital economy is not just about apps or QR codes — it’s about trust, awareness, and a collective shift in behavior. Once that happens, the benefits will far outweigh the costs.”

Bangladesh’s next challenge lies not in building the infrastructure — but in convincing its people to use it.