Top 20 defaulters of 6 banks: Debt recovery will take 333 years

- Update Time : Thursday, October 2, 2025

TDS Desk:

Recovery of funds from the top 20 defaulters of six state-owned banks remains minimal. A significant portion of these loans was taken on political grounds. In some cases, influential industrialists and businessmen obtained the money through collusion with banks, while in others, they intervened in banking operations. Now the banks are failing to recover the funds. Yet this money originates from public deposits.

At present, the volume of defaulted loans in the six state-owned banks stands at 1491.40 billion (1,49,140 crore) taka. Of this, 854.44 billion (85,444 crore) taka is stuck with 120 top defaulter clients of the six banks (20 from each bank). The six state-owned banks are Sonali, Agrani, Janata, Rupali, BASIC and BDBL.

In 2025, these six banks had set a target to recover at least 80.77 billion (8,077 crore) taka. From January to June, in six months, they managed to recover only 1.28 billion (128 crore) taka, or 1.58 per cent, from the 120 top defaulter clients. At this pace, it would take 333 years to recover the outstanding loans from the top 20 defaulters of the six banks.

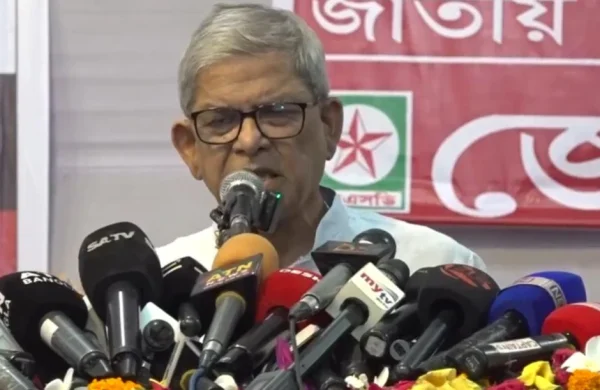

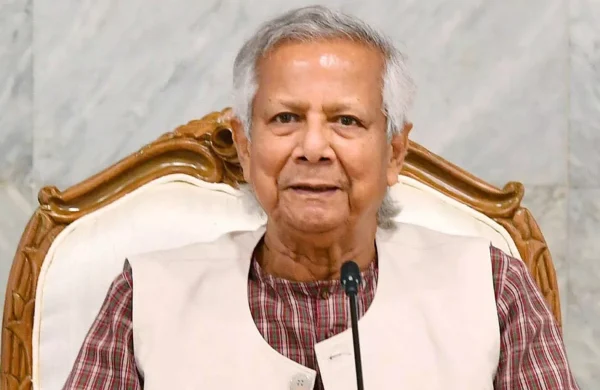

To review the overall situation of these banks, Financial Adviser Salehuddin Ahmed recently summoned the Financial Institutions Division of the Ministry of Finance. At a meeting in the Secretariat in Dhaka with the Managing Directors (MD) of the six banks, Financial Institutions Division Secretary Nazma Mobarek was also present. She presented the overall situation of the banks during the meeting.

The Financial Adviser was informed at the meeting that, as of December 2024, the 854.44 billion (85,444 crore) taka owed by the top 20 defaulter clients of the six banks accounted for 57 per cent of their total defaulted loans. Of this total, 538.48 billion (53,848 crore) taka, or 63 per cent, is owed to Janata Bank alone by its top 20 clients.

Financial Adviser Salehuddin Ahmed told journalists that the banks have been instructed to intensify their efforts to recover loans from the top 20 defaulters. Monitoring of recovery efforts must also be carried out every one to two months. The problem arises because clients file writ petitions in court. Therefore, reputed lawyers must be engaged to fight in court.

When asked about the government’s stance on the higher costs of appointing reputed lawyers, the Financial Adviser said, “They can take more and more bonuses, yet they cannot appoint competent lawyers – that is unacceptable. The banks will have to show the expenses for appointing lawyers. I am trying to sit with the Legal Adviser and the Attorney General to see whether a separate bench can be arranged.”

WHY IS RECOVERY SO LOW

The amount owed to Janata Bank by its top 20 defaulter clients is the highest. This situation has arisen due to indiscriminate lending of high-risk loans. Of the 538.48 billion (53,848 crore) taka owed by the bank’s top 20 defaulters, nearly 400 billion (40,000 crore) taka is stuck with just three clients—Beximco, S. Alam and AnanTex.

In 2025, Janata Bank had set a recovery target of 53.85 billion (5,385 crore) from top defaulters. However, in the first six months of the year, the bank has managed to recover only 151.2 million (15 crore 12 lakh) taka.

Janata Bank’s Managing Director, Mojibur Rahman, stated, “Other indicators are improving apart from recovery from defaulter clients. For instance, deposits have now increased to 1,25,000 crore. Inflows of remittances are also strong. We have also recovered more than anyone else from written-off loans.”

Explaining the reasons for low recovery from top defaulters, Mojibur Rahman said, “Past mistakes remain. However, we have filed cases for recovery. Against these cases, clients have filed writ petitions. We are working through the legal process to have these writs dismissed.”

Agrani Bank is owed 116.47 billion (11,647 crore) taka by its top 20 defaulter clients. Against its recovery target of BDT 892 crore, the bank has recovered only 1.9 billion (19 crore) taka.

Compared with others, Rupali Bank has recovered more in line with its target. Its top 20 defaulter clients owe 101.27 billion (10,127 crore) taka. Against this year’s recovery target of 10 billion (1,000 crore) taka, the bank has so far recovered 902.8 million (90 crore 28 lakh).

Among the four large banks, Sonali Bank’s recovery is the lowest, only 5 million (50 lakh) taka. Its top 20 clients owe 67.43 billion (6,743 crore) taka. The bank had set an annual recovery target of 3 billion (300 crore) taka but in six months managed to recover only 5 million (50 lakh) taka.

In addition, BASIC Bank is owed 25.79 billion (2,579 crore) taka by its top 20 clients. It had set a target to recover 4 billion (400 crore) taka in one year but has so far recovered only 1 million (10 lakh) in six months. BDBL, with 5 billion (500 crore) taka in defaulted loans, had set a target of recovering 1 billion (100 crore). It has managed to recover 30.5 million(3 crore 5 lakh) taka.