Weak banks to get special cash support this week

- Update Time : Sunday, September 15, 2024

TDS Desk:

The banking sector regulator, Bangladesh Bank, is set to facilitate liquidity support for the banks that have been struggling due to irregularities and corruption.

The boards of directors of these banks have already been replaced, and now they will receive liquidity support from strong banks, with Bangladesh Bank as guarantor.

Following the political changeover, the central bank shifted away from printing money for helping the weak banks to remain afloat. However, a special initiative has been taken to provide cash support to them, and the central bank officials are working tirelessly, even on the weekend, for its implementation.

According to the officials, they have been working to determine the policy for the cash support. Once it is finalised, there will be contacts with the banks concerned and the cash support will be dispatched.

It was learned that the regulator is planning to arrange the liquidity support within this week.

A central bank official told that, “The way of looting money from these banks has been blocked. Small depositors are panicking and rushing to banks to withdraw money. There have also been untoward incidents after failure in availing money. If this continues, even strong banks could be affected. Hence, they will be given cash support to deal with the pressure.”

The official hoped that the pressure would subside after the liquidity support. Later, initiatives will be taken to reconstitute the banks. And there might be initiatives for mergers if any bank fails to bounce back.

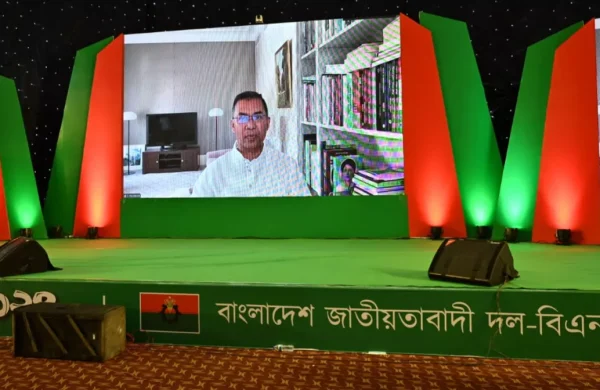

Following the fall of the Awami League government on 5 August, then-governor of Bangladesh Bank, Abdur Rauf Talukder, went into hiding, and economist Ahsan H Mansur took over the charge under the interim government.

Soon after assuming the position, he dissolved boards of directors of 11 banks and a financial institution that were struggling due to irregularities and corruption and were out of the regulator’s control.

The banks are – Islami Bank, Social Islami Bank, First Security Islami Bank, Union Bank, Global Islami Bank, Commerce Bank, Al-Arafah Islami Bank, National Bank, UCB, IFIC Bank, Exim Bank, and Aviva Finance. Of them, nine were controlled by the S Alam Group, which allegedly took out nearly Tk 2,000 billion from the entities, leading to the liquidity crisis.

According to sources, depositors – both small and large – have been crowding at banks to withdraw their money, following the changes in boards. It exacerbated the cash crunch, while the banks’ failure to pay all clients gave rise to panic.

Meanwhile, some banks got their check clearing facility suspended due to a large-scale deficit in their current account. Their clients are even restricted from withdrawing money from ATM booths.

Mohammad Abdul Mannan, chairman of First Security Islami Bank, told that the central bank is well aware of the situation of his bank, and it needs unconventional support to improve the situation.

“We assure that no more money will be mishandled. We have announced that deposits should be invested in the areas where they are raised. It will develop remote areas and bring relief to depositors,” he said.

On 8 August, Bangladesh Bank governor Ahsan H Mansur disclosed to the media that the central bank would facilitate interbank lending to ensure liquidity support. In such cases, the central bank will act as a guarantor for the weaker banks.

The Bangladesh Bank usually lends against bills, bonds, or collateral. As the weak banks lack sufficient collateral, the central bank will now serve as their guarantor. It will make agreements with both the banks requiring assistance and those providing liquidity.

This support will be provided for different periods, including three months, six months, or one year. After availing the support, the banks can prioritise small depositors while returning deposits and gear up their loan realisation. They can also lend small loans to keep their income uninterrupted.

Some banks have already applied to the central bank to avail the cash support, while some others are expected to follow.

Banks across the world receive liquidity support based on their asset values. As the weak banks saw their asset values being negative, the central bank is trying to facilitate liquidity support in a new way.

Mohammad Nurul Amin, chairman of Global Islami Bank, hoped that they could recover with the Bangladesh Bank’s assistance. “Once the pressure of small depositors to withdraw money is tackled, the focus will be shifted to restructuring the banks. It has been ensured that no further funds will get out of the banks.”

In a recent press conference, governor Ahsan H Mansur hoped that no bank would go bankrupt. They will assess each case of bad debt separately and identify the true owners.

The authorities will investigate the families involved and their assets. This process will continue, and this is the final solution, he added.