Who own BO accounts frozen by regulator, why the crackdown

- Update Time : Friday, May 23, 2025

TDS Desk:

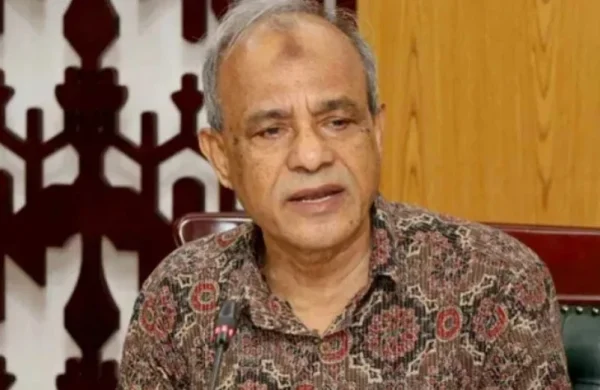

The new securities commission under the leadership of Khondoker Rashed Maqsood froze assets in 617 beneficiary owner’s (BO) accounts mostly upon receiving court orders or requests from several government agencies over corruption allegations.

There were also cases of misconduct, mainly share price manipulation, and non-compliance with securities laws, and so, the Bangladesh Securities and Exchange Commission (BSEC) took regulatory actions against the account owners.

As many as 484 accounts have been frozen on request of the Bangladesh Financial Intelligence Unit, the Anti-Corruption Commission and court orders, 109 frozen under BSEC’s enforcement actions, and 18 dealer accounts of brokers frozen over fund deficits in customers’ consolidated accounts (CCA).

Six other suspended accounts belong to asset management firms. They are subject to BSEC investigation over allegations of mismanagement of clients’ funds.

INFLUENTIAL INDIVIDUALS

Among the frozen account holders, 33 influential individuals were affiliated with the previous Awami League-led government. They had opened a total of 127 BO accounts under the name of their family members, relatives, or associated businesses.

The account holders include former minister for home affairs Asaduzzaman Khan Kamal, his wife Lutful Tahmina Khan, and their son and daughter; former foreign minister Mohammed Hasan Mahmud, his spouse Nurun Fatema Hasan and their daughter; and former state minister Mohammad Ali Arafat and his wife Sharmin Mustary.

Former state minister Zunaid Ahmed Palak, his wife Arifa Jesmin Konika, former MP Mohiuddin Maharaj, his wife Umme Kulsum, and his son Sammam Junaid Efti’s BO accounts have also been suspended.

Former land minister Saifuzzaman Chowdhury Javed, his spouse Rukhmila Zaman Chowdhury, his daughter Zeba Zaman Chowdhury, his relative Zara Zaman, his sister Roxana Zaman Chowdhury and his brother Anisuzzaman Chowdhury are facing the same regulatory measure.

The regulator has also frozen the BO accounts of former IGP of Police Benazir Ahmed and his family members and former chairman of Rajuk Major General (Retd) Md Siddiqur Rahman Sarker and his wife Gazi Rebeka Rowshan following court orders over graft charges.

Siddiqur, during his tenure as chairman of Rajuk (Rajdhani Unnayan Kartripakkha), amassed huge wealth illegally in his and his family members’ names through allocation of plots in Purbachal New Town project, according to the ACC.

The BSEC also froze BO accounts of former chairman of National Bank and Sikder Group founder late Zainul Haque Sikder and his family members.

All of these individuals are accused of acquiring illegal assets worth hundreds of millions of taka at home and abroad through the abuse of power and corruption during the previous government. At present, they are being investigated by the ACC.

ENFORCEMENT ACTIONS

As many as 109 BO accounts have been frozen primarily for share price manipulation.

The account holders include cricketer Shakib Al Hasan and controversial investor Abul Khayer Hiru and his associates.

The regulatory enforcement action is part of bringing necessary reforms to ensure transparency and accountability in the capital market.

In a major drive to enforce compliance, the BSEC also slapped big fines on several market manipulators and companies for involvement in malpractices during the tenure of the previous commission.

Hiru has been fined several times in the past five years over alleged stock manipulation. He was an influential investor in the market during the regime of former chairman of the securities regulator Shibli Rubayat Ul Islam.

ACCOUNT SUSPENSION FOR CCA SHORTFALL

As part of actions against unruly brokers, accounts of owners and directors of brokerage houses and dealer accounts were suspended due to the misuse of investors’ funds held in Consolidated Customers’ Accounts (CCAs).

Each brokerage house is required to maintain a CCA to keep unused investor funds, which may only be used for share transactions on behalf of clients.

However, some brokerage owners diverted these funds for other purposes, resulting in fund deficits.

The non-compliant brokerage firms include Moshihor Securities, Dhanmondi Securities, and PFI Securities.

Trading at Moshihor Securities, which allegedly embezzled around Tk 1.69 billion of its clients’ funds, is suspended. Dhanmondi Securities took away Tk 77.4 million from clients’ funds as of August 20 last year, while PFI Securities misappropriated Tk 276.2 million as of July 7 this year. Both the firms are not allowed to trade in stocks anymore.

ASSETS OF ASSET MANAGEMENT COMPANIES FROZEN

Six accounts belonging to owners, directors, and CEOs of asset management companies, including CWT, were frozen following recommendations from a BSEC-formed investigation committee.

Meanwhile, more than 100,000 BO accounts have been closed in the past one year as many investors left the market, incurring huge losses due to the depressed state of the stock market, while some squeezed their investment into one or two portfolios.

The total number of BO accounts came down to 1.69 million as of Thursday from 1.79 million a year ago, according to the Central Depository Bangladesh Limited (CDBL) that preserves electronic data of all individual and institutional investors.

To trade in the secondary market and apply for primary shares, an investor has to open a BO account with the CDBL through a depository participant which is usually a stockbroker or a merchant bank.